Kenneth C. Griffin

Kenneth Cordele Griffin (born October 15, 1968) is an American hedge fund manager, entrepreneur and investor. He is the founder, chief executive officer, co-chief investment officer, and 80% owner of Citadel LLC,[1][2] a multinational hedge fund. He also owns Citadel Securities, one of the largest market makers in the U.S.[3]

Ken Griffin | |

|---|---|

Griffin in 2017 | |

| Born | Kenneth Cordele Griffin October 15, 1968 Daytona Beach, Florida, U.S. |

| Education | Harvard University (BA) |

| Occupation(s) | Hedge fund manager Entrepreneur Investor |

| Years active | 1990–present |

| Known for | Founder of Citadel LLC and Citadel Securities |

| Title | CEO and co-CIO, Citadel LLC |

| Political party | Republican |

| Spouses | |

| Children | 3 |

As of April 2023, Griffin had an estimated net worth of $35 billion, making him the 38th-richest person in the world. He was ranked 21st on the 2022 Forbes 400 list of richest Americans.[4] He was included in Forbes's 2023 list of the United States' Most Generous Givers, according to which he has donated $1.56 billion to various charitable causes, primarily in education, economic mobility and medical research.[5]

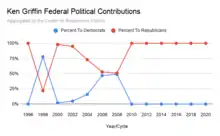

Griffin has contributed tens of millions of dollars to political candidates and causes, usually Republican or conservative in ideology.

Early life and education

Griffin was born in 1968 in Daytona Beach, Florida, the son of a building supplies executive.[6] His father had various jobs, and was a project manager for General Electric.[7] Griffin's grandmother, Genevieve Huebsch Gratz, inherited an oil business, three farms, and a seed business.[8]

Griffin grew up in Boca Raton, Florida, with some time in Texas, and Wisconsin.[9] He went to middle school in Boca Raton[7] and Boca Raton Community High School, where he was the president of the math club.[9][10] In high school, Griffin ran a discount mail-order education software firm, EDCOM, out of his bedroom.[10] In a 1986 article in the Sun-Sentinel, he said he thought he would become a businessman or lawyer and that he believed the job market for computer programmers would significantly decrease over the coming decade.[10]

Griffin started at Harvard College in the fall of 1986.[9] That year, one of his first investments was to buy put options on Home Shopping Network, making a $5,000 profit.[11] He also invested in convertible arbitrage opportunities in convertible bonds.[9] Despite a ban on running businesses from campus, Griffin convinced school administrators to allow him to install a satellite dish on the roof of Cabot House, a dormitory, to receive stock quotes.[11][9] He also asked Terrence J. O'Connor, the manager of convertible bonds at Merrill Lynch in Boston, to open a brokerage account for him with $100,000 that Griffin had gotten from his grandmother, his dentist, and others.[7][9] His first fund launched in 1987 with $265,000, days after his 19th birthday.[9] The fund launched in time to profit from short positions on Black Monday (1987).[9] Griffin graduated in 1989 with a degree in economics.[12]

Career

After graduating in 1989, Griffin moved to Chicago to work with Frank Meyer, founder of Glenwood Capital Investments.[13][14] Meyer allotted $1 million of Glenwood capital for Griffin to trade[14] and Griffin made 70% in a year.[9]

In 1990, Griffin founded Citadel LLC, with assets under management of $4.6 million, aided by contributions from Meyer.[14] His funds made 43% in 1991 and 40% in 1992.[11]

In the early 2000s, Griffin founded market maker Citadel Securities.[15][16]

In 2003, aged 34, Griffin was the youngest person on the Forbes 400, with an estimated net worth of $650 million.[17]

From the time of his second marriage to Anne Dias in 2003 until late 2009, Griffin was the lead investor in Aragon Global Management, a hedge fund run by his then-wife Anne Dias-Griffin. The fund was also seeded with money from Julian Robertson. Griffin lost 20% of his investment in the fund.[18]

In 2006, Citadel acquired the positions of Amaranth Advisors at a steep discount.[9]

During the financial crisis of 2007-2008, for 10 months, Griffin barred his investors from withdrawing money, attracting criticism.[2][19] At the crisis's peak, the firm was losing "hundreds of millions of dollars each week".[20] It was leveraged 7:1 and the biggest funds at Citadel finished 2008 down 55%, but rebounded with a 62% return in 2009.[9]

From Citadel LLC, Griffin earned $900 million in 2009,[21] $1.4 billion in 2014,[22] $600 million in 2016,[23] $1.4 billion in 2017,[24][25] $870 million in 2018,[26] $1.5 billion in 2019,[27] and $1.8 billion in 2020.[28]

In 2015, at his own expense, Griffin hired Katy Perry and Maroon 5 to entertain his employees.[29]

In November 2020, according to Bloomberg News, Griffin's net worth surpassed $20 billion due to an increase in the value of Citadel, of which Griffin's stake was worth $11.2 billion.[30] Citadel Securities, a market maker, increased its profit to $2.36 billion during the first half of 2020 compared to $982 million for the same period in 2019, due to increased volatility, volume and retail trader engagement.[31][32]

In January 2021, Griffin attracted criticism for the role Citadel played in the GameStop short squeeze.[33] On January 25, it was announced that Citadel would invest $2 billion into Melvin Capital, which had suffered losses of more than 30% on account of its short positions, particularly on GameStop.[34][35][36] On January 28, Robinhood, an electronic trading platform favored by many traders involved in buying GameStop stock and options, announced that it would halt all purchases of GameStop securities and only allow these securities to be sold; the price of GME stock declined steeply shortly thereafter.[37] Because Robinhood receives a substantial portion of its revenue through a payment for order flow relationship with Citadel, 85% of which is owned by Griffin, many commentators criticized the potential for conflict of interest when the same entity both plays the role of market-maker and also participates in the market it makes; Griffin has been at the center of much discussion of this controversy.[38][39][40][41][42] On February 18, 2021, he testified before the House Financial Services Committee about his role in the GameStop controversy;[42][43] Griffin had donated money directly to four members of the committee, Republicans French Hill, Andy Barr, Ann Wagner, and Bill Huizenga.[42]

Philanthropy

Education

Griffin has worked with the Bill and Melinda Gates Foundation to promote charter schools in the U.S.[9] and fund tutoring.[44]

In 2011, he worked with University of Chicago economics professor John A. List to test whether investment in teachers or in parents produces better student performance outcomes.[45]

At the beginning of 2014, Griffin made a $150 million donation to the financial aid program at Harvard University, his alma mater, the largest single donation ever made to the institution at the time.[46][47]

In 2014, he was elected to a five-year term on the University of Chicago's board of trustees. He is also a member of the Economic Club of Chicago and the civic committee of the Commercial Club of Chicago.[48] Griffin is the vice chairman of the Chicago Public Education Fund.[46]

In October 2017, Griffin's charitable fund donated $1 million to the Obama Foundation.[49][50]

In November 2017, Griffin's charitable fund made a $125 million gift to support the Department of Economics of the University of Chicago, renamed the Kenneth C. Griffin Department of Economics.[51]

In April 2021, he donated $5 million to an initiative to provide Internet access to students in Miami.[52]

Griffin donated $21.5 million to the Field Museum of Natural History and its dinosaur exhibit is named the Griffin Dinosaur Experience.[53]

In October 2019, Griffin's charitable fund announced a $125 million gift to the Museum of Science and Industry in Chicago, the largest gift in the museum's history. The museum was renamed the Kenneth C. Griffin Museum of Science and Industry.[54][55]

In November 2021, Griffin outbid a group of crypto investors to purchase the last privately held copy of the United States Constitution at auction for $43.2 million. Griffin said, "I intend to ensure that this copy of our Constitution will be available for all Americans and visitors to view and appreciate in our museums and other public spaces", with plans to display it first at the Crystal Bridges Museum of American Art in Arkansas.[56][57]

In March 2022, Griffin donated $40 million to the American Museum of Natural History in New York to help complete the 230,000 square foot renovation.[58]

In July 2022, he donated $130 million to Chicago nonprofits before his move to Florida.[59]

Griffin made a donation of $250,000 to a Miami scholarship program for STEM students in 2022, his first donation since moving Citadel's headquarters there.[60]

In April 2023, Griffin made a donation of $300 million to the Harvard Faculty of Arts and Sciences, and Harvard announced that it would rename its Graduate School of Arts and Sciences (GSAS) the Kenneth C. Griffin Graduate School.[61][62] A few weeks later, Griffin donated $25 million to Success Academy Charter Schools, New York City's largest charter school network,[63] and gave $20 million to Miami Dade College, where he also addressed the 2023 graduating class.[64]

Poverty

Griffin supported the University of Chicago's Center for Urban School Improvement, a program encouraging the construction of an inner-city charter high school,[6] and contributed to the Lurie Children's Hospital.[65]

In 2017, Griffin contributed $15 million to the Robin Hood Foundation.[66]

In May 2022, The University of Chicago announced a $25 million donation from Griffin to launch an initiative design to train police managers and prevent neighborhood violence. The funds will aid in launching two community Safety Leadership Academies. The Policing Management Academy aims to professionalize departments by educating their leaders though coaching, accountability and data-driven decision making. This donation came after Griffin's $10 million donation to the Crime Lab in 2018 to implement an early intervention system to investigate citizen complaints.[67]

Arts

Griffin served on the board of trustees of the Museum of Contemporary Art, Chicago from 2000 to 2022.[68][69]

In July 2007, Griffin donated a $19 million addition to the Art Institute of Chicago designed by Renzo Piano and named Kenneth and Anne Griffin Court.[70] The Paul Cézanne paintings have also been loaned to the institute.[6]

In 2010, Griffin contributed to the Chicago Symphony Orchestra's productions at Millennium Park.[6]

Griffin contributed to the Art Institute of Chicago[9] and resigned from its board in 2022.[71] He serves on the board of trustees at the Whitney Museum of American Art in New York, whose lobby bears his name: Kenneth C. Griffin Hall.[72] In February 2015, Griffin donated $10 million to the Museum of Contemporary Art, Chicago, used to create the Griffin Galleries of Contemporary Art.[69][73]

In December 2015, he donated an unrestricted $40 million to the Museum of Modern Art in New York.[72]

In 2018, he donated $20 million to the Norton Museum of Art.[74]

Religion

Griffin is a member of the Fourth Presbyterian Church of Chicago, where he was married.[75][76] In 2011, he donated $11.5 million of the $38.2 million needed to build a new chapel at the church.[75] The modern building is called "The Gratz Center" in honor of Griffin's grandparents.[75]

COVID-19 donations

Griffin oversaw a $2 million donation from Citadel and Citadel Securities to Weill Cornell Medicine to help fund the development of new ways to protect people from COVID-19 and identify new cases of the illness.[77]

In March 2020, in response to the COVID-19 pandemic, Griffin contributed $2.5 million to support food services for children in Chicago Public Schools.[78]

In May 2020, Griffin and his partners at Citadel made a £3 million donation to help develop a COVID-19 vaccine and to support Nightingale Hospital.[79]

Personal life

Marriages

Griffin's first wife was Katherine Weingartt, his high-school sweetheart. The couple divorced in 1996.[80][81]

In March 2002, Griffin met his second wife, Anne Dias-Griffin after being set up on a blind date by a mutual friend.[76][82] She is a French-born graduate of Harvard Business School who worked at Goldman Sachs, Soros Fund Management, and Viking Global Investors before starting the Chicago-based $55 million firm[83] Aragon Global Management.[84] The couple married in July 2003[18] and had three children.[84]

In July 2014, Griffin filed a divorce petition in Cook County, Illinois, citing "irreconcilable differences" with Dias-Griffin.[85][86] The couple had a prenuptial agreement that governed the split of their assets in the event of divorce.[84][87][88][89] As part of the agreement, Dias-Griffin received $22.5 million at the beginning of their marriage and an additional $1 million each year they were married.[85][87] During the marriage, she received $37 million in cash payments and 50% ownership of their Chicago penthouse, which occupies three floors of the building.[90] In court fillings, she claimed that she was forced to sign the prenuptial agreement.[85][91] She also claimed that Ken Griffin had no right to enter the Chicago penthouse.[92][93] He allegedly forbade her from entering homes in Hawaii, Miami, Colorado and New York.[85] In later court filings, Dias-Griffin requested $1 million per month in child support payments, including $300,000 per month for private jet travel, $160,000 per month for vacation rentals, and $60,000 per month for office space and staff.[94][95][96][97] Griffin claimed that Dias-Griffin was attempting to use child support to fund her "opulent lifestyle".[98] During the divorce, she requested $450,000 for a 10-day vacation to St. Barts over winter break with their three children. Griffin denied her request but agreed to pay $45,000 for a winter vacation.[99][100][82] The couple settled their divorce out of court in October 2015, just hours before a public trial over the prenuptial agreement was set to begin.[101][85] As part of the divorce, Griffin paid $11.75 million to buy out his wife's interest in their Chicago penthouse.[102] He and Dias-Griffin maintain joint custody of their children.[85][103][104][105][91]

Political views

In a 2012 interview with the Chicago Tribune, Griffin said that the rich actually have too little influence in politics.[106] He identified as a Ronald Reagan Republican. He said the belief "that a larger government is what creates prosperity, that a larger government is what creates good" is wrong.[107]

In a November 2015 interview on CNBC, Griffin said he admires Scott Walker, calling him an "absolute champion of free markets and a champion of smaller government".[108]

In April 2016, because Citadel owned over 1 million shares of McDonald's, Griffin was the target of protestors supporting the Fight for $15.[109] In May 2017, he praised Donald Trump's efforts at tax and healthcare reform[110]

In 2018, it was announced that Griffin had been appointed the national finance chair for the New Republican PAC fueling Rick Scott's Super PAC.[111]

In November 2018, Griffin criticized Trump's tweets berating Chair of the Federal Reserve Jerome Powell, calling them "completely inappropriate for the president of the United States".[112][113][114]

In January 2019, Griffin was singled out by Elizabeth Warren on a Facebook post as someone who can pay her Ultra-Millionaire Tax.[115] During a March 2019 interview with David Rubenstein, he criticized Warren's proposals, saying, "soaking the rich doesn't work".[116]

In January 2020, Griffin was absent from a signing ceremony for the phase-one trade deal with China at the White House, for which Trump criticized him.[117][118]

In September 2020, Griffin wrote an op-ed published in the Chicago Tribune stating his opposition to Governor of Illinois J. B. Pritzker's "Fair Tax" proposal, which would change Illinois's income tax from a flat tax to a graduated tax.[119][120] In an October 2020 email to Citadel LLC's Chicago employees, Griffin criticized Pritzker's tax plan and alluded to the possibility of moving his company out of Illinois.[121][122]

While being interviewed by Paul Tudor Jones at the Robin Hood Foundation investor conference in October 2020, Griffin criticized Joe Biden's plans to raise the long-term capital gains tax rate.[123][124]

Following the 2023 Hamas strike on southern Israel, Griffin contacted the Harvard Corporation leadership to demand a university response, including a condemnation of 30 student groups that signed a letter critical of Israel. He also condoned statements by fellow alumnus and donor Bill Ackman that his firm would not hire students who signed the letter.[125]

Political contributions

In a 2012 interview, Griffin said that people should be able to make unlimited contributions to politicians, but that the contributions should be public.[126]

Griffin has made political donations to conservative political candidates, parties, and organizations, such as American Crossroads and the Republican Governors Association.[126]

During the 2010 United States elections, Griffin donated $721,600 to federal candidates and political committees. Except for a $2,400 contribution to then United States Senate Committee on Banking, Housing, and Urban Affairs Chairman Chris Dodd, all the contributions were to Republicans.[127]

In December 2015, Griffin endorsed Marco Rubio for the 2016 Republican presidential nomination and said he planned to donate millions to a pro-Rubio super PAC.[128] Before this endorsement, he had donated $100,000 each to three super PACs supporting Rubio, Jeb Bush, and Scott Walker for the nomination.[129]

Griffin was the biggest donor to Rahm Emanuel's campaign for reelection as mayor of Chicago.[106]

After Trump won the 2016 Republican nomination, Griffin did not contribute to his campaign.[130]

In 2017, he contributed $20 million to the campaign of Governor of Illinois Bruce Rauner.[131]

In March 2020, Griffin contributed $1 million to the 1820 PAC created to support the reelection of U.S. Senator Susan Collins.[132] In late 2020, he donated another $500,000 to the 1820 PAC.[133]

In 2020, Griffin donated $20 million to the Coalition To Stop The Proposed Tax Hike Amendment, a group opposing the Illinois Fair Tax in its 2020 referendum.[120][134] Weeks later, he donated another $26.75 million to the coalition.[135][136] Griffin later donated another $7 million to the group, bringing his total contributions to $53.75 million.[137][138]

In 2020, Griffin donated $2 million to an anti-retention effort for Justice Thomas L. Kilbride, a Democrat on the Supreme Court of Illinois.[139][140]

Griffin supported Kelly Loeffler and David Perdue in the 2020–21 United States Senate election in Georgia.[141] In October 2020, he was criticized for a $2 million contribution to a Super PAC supporting Loeffler and funded by her husband, New York Stock Exchange Chairman Jeffrey Sprecher just after one of Citadel LLC's companies needed Sprecher's approval for a merger.[142]

Griffin contributed a total of $66 million to the 2020 United States elections.[143]

Citadel gave $800,000 to Janet Yellen for speaking fees.[144]

In 2021, Griffin donated $5 million to Ron DeSantis, the governor of Florida.[145] Griffin's donations to DeSantis prompted criticism of a possible conflict of interest when DeSantis began promoting Regeneron Pharmaceuticals' therapeutic treatment for COVID-19.[146][147][148][149] DeSantis has encouraged such monoclonal antibody treatment for COVID-19, which can treat people after they get sick and reduce hospitalization.[150] Shares in Regeneron were a $16 million investment by Griffin's hedge fund.[151][152] The fund denied any conflict of interest, noting that it had much larger investments in vaccine makers Pfizer and Moderna.[146][147][153][149] Likewise, a DeSantis spokesperson said that any suggestion of corruption over this connection to Griffin via Regeneron was illogical.[152] Griffin has at times criticized DeSantis, for example saying "I don't appreciate Governor DeSantis going after Disney's tax status".[154]

Later in 2021, Griffin promised to donate twice the amount to the Republican opponent of incumbent governor J. B. Pritzker that Pritzker gave himself for the 2022 Illinois gubernatorial election.[155]

On May 5, 2022, Griffin donated $1.5 million to Lisa Murkowski through Alaskans for L.I.S.A. (Leadership in a Strong Alaska).[156][157]

| Date | Amount | Recipient | Associated Party/Candidate |

|---|---|---|---|

| 2010-10-25 | $250,000 | American Crossroads | Republican |

| 2011-08-01 | $300,000 | American Crossroads | Republican |

| 2012-03-26 | $850,000 | Restore Our Future | Mitt Romney 2012 presidential campaign |

| 2012-03-28 | $700,000 | American Crossroads | Republican |

| 2012-10-09 | $500,000 | Restore Our Future | Mitt Romney 2012 presidential campaign |

| 2014-03-27 | $250,000 | American Crossroads | Republican |

| 2014-04-10 | $300,000 | Ending Spending Action Fund | Republican |

| 2014-09-22 | $800,000 | Ending Spending Action Fund | Republican |

| 2014-09-22 | $700,000 | American Crossroads | Republican |

| 2014-10-17 | $250,000 | Arkansas Horizon | Republican |

| 2015-02-03 | $950,000 | Rahm Emanuel | Democrat |

| 2015-04-15 | $250,000 | Future45 | Donald Trump |

| 2015-11-24 | $2,000,000 | Freedom Partners Action Fund | Republican |

| 2015-12-14 | $2,500,000 | Conservative Solutions PAC | Marco Rubio 2016 presidential campaign |

| 2015-12-30 | $500,000 | Ending Spending Action Fund | Republican |

| 2015-12-30 | $250,000 | Fighting For Ohio Fund | Republican |

| 2016-02-05 | $2,500,000 | Conservative Solutions PAC | Marco Rubio 2016 presidential campaign |

| 2016-08-03 | $1,000,000 | Congressional Leadership Fund | Republican (House of Representatives) |

| 2016-08-09 | $2,000,000 | Senate Leadership Fund | Republican (Senate) |

| 2017-08-02 | $1,000,000 | Congressional Leadership Fund | Republican (House of Representatives) |

| 2018-07-12 | $1,500,000 | Congressional Leadership Fund | Republican (House of Representatives) |

| 2018-10-16 | $250,000 | American Patriots PAC | Republican |

| 2018-10-18 | $2,000,000 | Congressional Leadership Fund | Republican (House of Representatives) |

| 2018-10-23 | $1,000,000 | Future45 | Donald Trump |

| 2018-10-25 | $400,000 | Ending Spending Action Fund | Republican |

| 2018-10-30 | $250,000 | Missouri Rising Action | Josh Hawley |

| 2019-06-28 | $1,000,000 | Congressional Leadership Fund | Republican (House of Representatives) |

| 2019-11-25 | $500,000 | Congressional Leadership Fund | Republican (House of Representatives) |

| 2020-03-13 | $1,000,000 | 1820 PAC | Susan Collins |

| 2020-05-07 | $2,000,000 | Congressional Leadership Fund | Republican (House of Representatives) |

| 2020-06-15 | $3,000,000 | Congressional Leadership Fund | Republican (House of Representatives) |

| 2020-06-15 | $3,000,000 | Congressional Leadership Fund | Republican (House of Representatives) |

| 2020-06-19 | $500,000 | Better Future Michigan Fund | John E. James |

| 2020-06-19 | $500,000 | Better Future Michigan Fund | John E. James |

| 2020-08-27 | $500,000 | 1820 PAC | Susan Collins |

| 2022-05-05 | $1,500,000 | Alaskans for L.I.S.A. | Lisa Murkowski |

Griffin has individually supported many candidates including:[159]

- Sen. Kelly Ayotte (R)

- Sen. Susan Collins (R)

- Sen. John Cornyn (R)

- Sen. Jeff Flake (R)

- Sen. Cory Gardner (R)

- Sen. Kelly Loeffler (R)

- Sen. Shelley Moore Capito (R)

- Sen. Lisa Murkowski (R)

- Sen. Marco Rubio (R)

- Sen. Rick Scott (R)

- Sen. Luther Strange (R)

- Sen. Dan Sullivan (R)

- Sen. Todd Young (R)

- Rep. Andy Barr (R)

- Rep. Mike Bost (R)

- Rep. Jeff Fortenberry (R)

- Rep. Virginia Foxx (R)

- Rep. Mike Gallagher (R)

- Rep. Mike Garcia (R)

- Rep. Bill Huizenga (R)

- Rep. Young Kim (R)

- Rep. Kevin McCarthy (R)

- Rep. Darin LaHood (R)

- Rep. Tom Reed (R)

- Rep. Dave Reichert (R)

- Rep. Ann Wagner (R)

- Rep. Bruce Westerman (R)

- Esther Joy King (R)

- Kris Kobach (R)

- Rahm Emanuel (D)

Art collection

Griffin is an active buyer of modern art and contemporary art from mainstream artists.[72][160] His portfolio is valued at close to $800 million and includes several paintings on the list of most expensive paintings.[161][162]

In 1999, he purchased Paul Cézanne's 1893 painting Curtain, Jug and Fruit Bowl for a record $60 million at the time.[9]

In October 2006, he purchased False Start by artist Jasper Johns for $80 million from David Geffen.[163] In 2015, he purchased Gerhard Richter's 1986 painting Abstract Picture, 599 for $46 million.[160]

In September 2015, in the largest private art deal ever, he purchased two paintings from Geffen for $500 million: Willem de Kooning's 1955 oil painting Interchange for $300 million, and Jackson Pollock's 1948 painting Number 17A for $200 million.[164][165]

In 2017, Griffin reportedly purchased Andy Warhol's 1964 painting Orange Marilyn privately for around $200 million

In June 2020, he purchased Boy and Dog in a Johnnypump (1982) by Jean-Michel Basquiat for over $100 million.[166][161] He loaned the painting to the Art Institute of Chicago to be put on public display.[167]

His collection also includes art by Njideka Akunyili Crosby.[168]

Personal residences

Griffin owns personal residences valued in total at around $1 billion.[169]

In 2009, Griffin purchased a full floor apartment at 820 Fifth Avenue in New York City for $40 million.[169][170][171]

In 2015, Griffin purchased two apartments at the top of the Faena House, a condominium on Collins Avenue in Miami Beach, Florida for $60 million. He sold them in late 2020 at a loss.[169][172]

In 2011, Griffin purchased two oceanfront homes at the Four Seasons Resort Hualalai in Kailua-Kona, Hawaii, for $28 million.[169][173][174]

In 2013 and 2015, Griffin purchased homes in Aspen, Colorado, for $10 million and $12.8 million respectively.[169][175]

In 2017, Griffin purchased a penthouse apartment atop the No. 9 Walton luxury condo tower in Chicago's Gold Coast for $58.75 million. The purchase broke the record for the most expensive sale in Chicago history. The condo was delivered as "raw space" so that Griffin could build it out to his liking.[169][176][177] Griffin also owns a full-floor penthouse at the Waldorf Astoria private residences across the street from No. 9 Walton. Records show he purchased it for $6.884 million in 2010.[169]

In 2019, Griffin purchased 3 Carlton Gardens, a Georgian mansion in London for $122 million. The purchase broke several records.[178][179][180]

In 2019, Griffin set the record for the most expensive residential sale ever closed in the U.S. when he purchased roughly 24,000 square feet across three floors at 220 Central Park South in Midtown Manhattan for $238 million. The space was "raw space", meaning Griffin had to build it out.[181][182][183] Several New York real estate experts have said that the purchase helped fuel legislation that increased taxes on luxury homes in New York.[184][185] During an interview with David Rubenstein, Griffin said that the purchase represented the possibility of making New York City his home in the future.[116]

Griffin has spent $450 million to assemble one of the largest private waterfront sites in Palm Beach County, Florida, with plans to build a 50,000 square foot estate.[169][186][187]

In 2020, Griffin purchased a 7-acre oceanfront compound in Southampton, New York from Calvin Klein for $84.4 million.[188]

In 2020, Griffin purchased several properties on Star Island in Miami Beach for a total of $95 million.[189]

In 2022, Griffin purchased a waterfront mansion in Coral Gables, Florida for $45.25 million.[190]

Private jets

Griffin owns two private jets: a 2001 Bombardier Global Express valued at $9.5 million and a $50 million 2012 Bombardier Global 6000.[191]

Withdrawn fraud accusation

In June 2006, Rush E. Simonson, claiming to be Griffin's mentor, filed a fraud case (2006-L-005997) against Griffin, alleging that he was entitled to a percentage of Citadel's profits for creating a computer program upon which Citadel was founded.[192][193] In court filings, Simonson said that he first befriended Griffin in 1982 as a computer salesman. The two struck up a business partnership in convertible-arbitrage. Griffin provided the trading savvy, working both out of his Harvard dorm room and at home in Florida, while Simonson allegedly created the computer program that served as its technological backbone. According to the suit, Griffin struck a deal with a prominent Chicago investor in the late 1980s. As Griffin and Simonson began to unwind their partnership, the suit claimed, Griffin instead began to lay the foundations of what would become Citadel. In doing so, Griffin allegedly improperly took the program that Simonson had created. Simonson also said in his lawsuit that Griffin did not give him a cut of Citadel's profits. In January 2007, he dropped the lawsuit and apologized to Griffin.[194][195]

In popular culture

Nick Offerman portrays Griffin in the 2023 film Dumb Money, a biographical drama about the GameStop short squeeze. Griffin claims that the original script contained many fabrications that he got Sony Pictures to correct before release, but still finds some of it sensationalized.[196][197]

See also

References

- Maloney, Tom (January 11, 2022). "Ken Griffin's Fortune Soars to $28 Billion". Bloomberg News. Archived from the original on May 11, 2022. Retrieved May 11, 2022.

- Copeland, Rob (August 3, 2015). "Citadel's Ken Griffin Leaves 2008 Tumble Far Behind". The Wall Street Journal. Dow Jones & Company. ISSN 0099-9660. Archived from the original on December 13, 2019.

- Detrixhe, John (February 5, 2021). "Citadel Securities gets almost as much trading volume as Nasdaq". Quartz. Archived from the original on July 10, 2022. Retrieved July 28, 2022.

- "Ken Griffin - Founder & CEO, Citadel LLC". Forbes. ISSN 0015-6914. Archived from the original on November 5, 2017. Retrieved October 20, 2017.

- "America's Most Generous Givers 2023: The Nation's 25 Top Philanthropists". Forbes. January 23, 2023. Archived from the original on January 23, 2023. Retrieved January 23, 2023.

- Reed, Robert (October 3, 2005). "Hedge Fun". Chicago. Archived from the original on December 20, 2019.

- Anderson, Jenny (April 4, 2007). "Will a Hedge Fund Become the Next Goldman Sachs?". The New York Times. ISSN 1553-8095. Archived from the original on November 16, 2017.

- Harris, Melissa. "Lessons, legacy of Ken Griffin's grandmother stick with billionaire". Chicago Tribune. Archived from the original on September 29, 2018.

- Meyer, Graham (June 8, 2011). "The File on Citadel's Ken Griffin". Chicago. ISSN 0362-4595. Archived from the original on December 14, 2019.

- Santaniello, Neil. "FOR TEAM OF BOCA STUDENTS, COMPUTER'S SCREEN IS ARENA". Sun-Sentinel. Archived from the original on October 27, 2020.

- "Boy Wonder". Institutional Investor. August 31, 2001. Archived from the original on February 21, 2020. Retrieved April 4, 2021.

- Clarida, Matthew Q.; Hashmi, Amna H. (February 19, 2014). "Griffin '89 Gives $150 Million to Harvard, Largest Gift in College's History". The Harvard Crimson. Archived from the original on March 22, 2021. Retrieved April 3, 2021.

- Kolhatkar, Sheelah (April 16, 2007). "Opening Up the Citadel". American City Business Journals. Archived from the original on October 26, 2020.

- Vickers, Marcia (April 3, 2007). "A hedge fund superstar - Citadel founder Ken Griffin is already one of the world's most powerful investors". Fortune. Archived from the original on December 14, 2019.

- "Ken Griffin". Forbes. Archived from the original on November 5, 2017. Retrieved October 20, 2017.

- Wolverson, Roya (February 18, 2021). "How Ken Griffin's Citadel transformed financial markets". Quartz. Archived from the original on November 23, 2021. Retrieved December 3, 2021.

- "America's rich get richer". CNN. September 19, 2003. Archived from the original on December 26, 2019.

- Kapos, Shia (February 20, 2015). "Ken Griffin gives his side of the blowup in the bedroom". Chicago Business. Crain Communications. ISSN 1557-7902. Archived from the original on December 26, 2019.

- Boak, Joshua (December 13, 2008). "Citadel suspends fund redemptions". Chicago Tribune. Archived from the original on April 9, 2021. Retrieved April 3, 2021.

- "Citadel chief rails against megabanks". Financial Times. September 10, 2013. Archived from the original on April 9, 2021. Retrieved April 4, 2021.

- Veneziani, Vince (April 1, 2010). "Meet The Top 10 Earning Hedge Fund Managers Of 2009". Business Insider. Archived from the original on May 18, 2021. Retrieved February 21, 2021.

- Gandel, Steven (May 5, 2015). "The highest paid hedge fund manager only made $1.3 billion last year". Fortune. Archived from the original on March 4, 2021. Retrieved April 3, 2021.

- "Kenneth Griffin". Institutional Investor. May 29, 2018. Archived from the original on September 29, 2022. Retrieved November 1, 2020.

- Frank, Robert (May 30, 2018). "These hedge fund managers made more than $3 million a day last year". CNBC. Archived from the original on October 12, 2020.

- Janssen, Kim. "Ken Griffin rated nation's best-paid hedge fund manager, again". The Capital. Archived from the original on October 27, 2020.

- Maloney, Tom (February 15, 2019). "The Best-Paid Hedge Fund Managers Made $7.7 Billion in 2018". Bloomberg News. Archived from the original on October 12, 2020.

- Franck, Thomas (March 26, 2020). "Hedge fund titans Simons, Griffin, Cohen and Tepper earned $1 billion in 2019 before virus outbreak". CNBC. Archived from the original on May 27, 2020.

- Taub, Stephen (February 22, 2021). "The 20th Annual Rich List, the Definitive Ranking of What Hedge Fund Managers Earned in 2020". Institutional Investor. Archived from the original on March 3, 2021. Retrieved March 3, 2021.

- Fox, Emily Jane (February 22, 2016). "Billionaire Hedge Funder Ken Griffin Continues to Live His Best Life". Vanity Fair. Archived from the original on October 12, 2020.

- Maloney, Tom (November 2, 2020). "Ken Griffin's Macro 'Dream' Propels Net Worth to $20 Billion". Bloomberg News. Archived from the original on November 3, 2020. Retrieved November 3, 2020.

- "Citadel Securities doubled profit as dominance grew in 2020". Crain Communications. September 25, 2020. Archived from the original on October 31, 2020. Retrieved November 3, 2020.

- Maloney, Tom; Bakewell, Sally (September 25, 2020). "Citadel Securities Doubled Profit as Dominance Grew in 2020". Bloomberg News. Archived from the original on October 7, 2020. Retrieved November 3, 2020.

- Ori, Ryan (January 29, 2021). "Chicago billionaire Ken Griffin faces controversy involving Wall Street chat rooms, Robinhood trading app and GameStop's stock". Chicago Tribune. Archived from the original on January 30, 2021. Retrieved January 30, 2021.

- "Steve Cohen provides funds for hedge fund protégé Gabe Plotkin". Financial Times. Archived from the original on January 29, 2021. Retrieved January 30, 2021.

- Chung, Juliet (January 25, 2021). "Citadel, Point72 to Invest $2.75 Billion Into Melvin Capital Management". The Wall Street Journal. ISSN 0099-9660. Archived from the original on January 28, 2021. Retrieved January 30, 2021.

- Mohamed, Theron (January 26, 2021). "GameStop short-seller down 30% this year gets $2.8 billion bailout from the firms of billionaire investors Steve Cohen and Ken Griffin". Business Insider. Archived from the original on April 12, 2023. Retrieved January 30, 2021.

- Fitzgerald, Maggie (January 28, 2021). "Robinhood restricts trading in GameStop, other names involved in frenzy". CNBC. Archived from the original on March 9, 2021. Retrieved January 30, 2021.

- "Ken Griffin, welcome to the white-hot national spotlight". Crain Communications. January 29, 2021. Archived from the original on January 29, 2021. Retrieved January 30, 2021.

- "Why are Robinhood traders bringing a class action lawsuit?". The Independent. January 29, 2021. Archived from the original on January 29, 2021. Retrieved January 30, 2021.

- Fitzgerald, Maggie (February 18, 2021). "Warren presses Citadel CEO Griffin about relationship with Robinhood, payment for order flow". CNBC. Archived from the original on February 22, 2021. Retrieved March 14, 2021.

- Burton, Katherine; Natarajan, Sridhar (February 1, 2021). "The Citadel Link: What Ken Griffin Has to Do With GameStop". Bloomberg News. Archived from the original on May 19, 2021. Retrieved March 21, 2021.

- Warmbrodt, Zachary (February 18, 2021). "Hedge fund king, a GOP megadonor, faces off with Democrats". Politico. Archived from the original on February 20, 2021. Retrieved February 19, 2021.

- Mitchell, Ian (February 18, 2021). "5 things to know about GameStop and what Ken Griffin has to tell Congress". Chicago Tribune. Archived from the original on February 19, 2021. Retrieved February 19, 2021.

- "Evidence-Based Tutoring Program Scales to Address Learning Loss and Persistent Opportunity Gaps in Major Urban Districts" (Press release). PR Newswire. August 10, 2020. Archived from the original on May 5, 2021. Retrieved April 8, 2021.

- Staley, Oliver (February 23, 2011). "Chicago Economist's 'Crazy Idea' Wins Ken Griffin's Backing". Bloomberg News. Archived from the original on December 20, 2019.

- Lauerman, John (February 20, 2014). "Citadel's Griffin Gives Harvard $150 Million for Student Aid". Bloomberg News. Archived from the original on December 20, 2019.

- Herbst-Bayliss, Svea (February 20, 2014). "Hedge fund manager Griffin gives $150 million to Harvard". Reuters. Archived from the original on May 30, 2019.

- Marek, Lynne (March 14, 2019). "Is Ken Griffin serious about a Citadel HQ move?". Crain Communications. ISSN 1557-7902. Archived from the original on March 4, 2020.

- Sweet, Lynn (October 13, 2017). "Republican mega donor Ken Griffin gives $1 million to Obama Foundation". Chicago Sun-Times. Archived from the original on May 19, 2021. Retrieved April 6, 2021.

- Abelson, Max (January 17, 2018). "Goldman Sachs and Ken Griffin Funds Give Big to Obama Foundation". Bloomberg News. Archived from the original on May 19, 2021. Retrieved April 6, 2021.

- Leubsdorf, Ben (November 1, 2017). "Citadel's Kenneth Griffin to Donate $125 Million for University of Chicago Economics". The Wall Street Journal. ISSN 0099-9660. Archived from the original on December 20, 2019.

- Williamson, Christine (April 5, 2021). "Ken Griffin donates $5 million to give Miami students internet". Pensions & Investments. Archived from the original on April 5, 2021. Retrieved April 6, 2021.

- Bertagnoli, Lisa (June 14, 2019). "The Field's CEO inherited a bit of a mess 7 years ago. Here's what he's done to clean it up". Crain Communications. ISSN 1557-7902. Archived from the original on December 20, 2019.

- "Museum of Science and Industry Announces Historic Gift From Kenneth C. Griffin Charitable Fund" (Press release). Business Wire. October 3, 2019. Archived from the original on May 15, 2021. Retrieved April 6, 2021.

- Johnson, Steve (October 4, 2019). "The Museum of Science and Industry is getting a new name after Chicago billionaire Ken Griffin donates $125 million". Chicago Tribune. Archived from the original on May 14, 2021. Retrieved April 6, 2021.

- Crow, Kelly (November 19, 2021). "Citadel CEO Ken Griffin Outbid a Group of Crypto Investors for Copy of U.S. Constitution". Wall Street Journal. ISSN 0099-9660. Archived from the original on November 19, 2021. Retrieved November 19, 2021.

- Kastrenates, Jacob (November 19, 2021). "A hedge fund billionaire outbid crypto investors for a rare copy of the US Constitution". The Verge. Archived from the original on November 19, 2021. Retrieved November 19, 2021.

- Gordon, Amanda L (March 29, 2022). "Ken Griffin Gives $40 million to NYC Natural History Museum". bloomberg.com. Retrieved March 23, 2023.

- Cherney, Elyssa (July 7, 2022). "Ken Griffin gives $130 million in parting gifts to local organizations". chicagobusiness.com. Archived from the original on March 23, 2023. Retrieved March 23, 2023.

- Mustak, Dayana; Gordon, Amanda L (October 12, 2022). "Ken Griffin Makes First Donation in Miami Since Moving Citadel". bloomberg.com. Retrieved March 23, 2023.

- "Kenneth C. Griffin makes gift of $300 million to FAS". Harvard Gazette. Harvard University. April 11, 2023. Archived from the original on April 11, 2023. Retrieved April 11, 2023.

- Wong, Julia Carrie; Kirchgaessner, Stephanie (April 11, 2023). "Harvard to rename school after top Republican donor following $300m gift". The Guardian. Archived from the original on April 12, 2023. Retrieved April 11, 2023.

- Gordon, Amanda L (April 25, 2023). "Ken Griffin Gives $25 Million to New York's Success Academy Schools". Bloomberg News.

- Chen, Shiyin (April 23, 2023). "Ken Griffin Gifts $20 Million, Life Lessons to Miami College". Bloomberg News.

- Harris, Melissa; Japsen, Bruce (January 7, 2010). "Kenneth and Anne Griffin give $16 million to Children's Memorial Hospital". Chicago Tribune. Archived from the original on February 13, 2015.

- Gordon, Amanda (April 27, 2017). "Hedge Fund Billionaire Griffin to Give $15 Million to Robin Hood". Bloomberg News. Archived from the original on December 26, 2019.

- "University of Chicago Crime Lab receives $27.5 million". Philanthropy News Digest. May 13, 2022. Archived from the original on May 13, 2022. Retrieved May 17, 2022.

- "Ken Griffin's move means he'll step back from Chicago nonprofit boards". Crain's Chicago Business. June 23, 2022. Archived from the original on March 20, 2023. Retrieved March 20, 2023.

- "MCA gets $10 million from Ken Griffin". Crain Communications. February 20, 2015. ISSN 1557-7902. Archived from the original on May 2, 2019.

- "Citadel's Griffin at the Art World's Gates". The New York Times. July 26, 2007. Archived from the original on November 7, 2017.

- Cherney, Elyssa (June 23, 2022). "Ken Griffin's move means he'll step back from Chicago nonprofit boards". chicagobusiness.com. Archived from the original on March 20, 2023. Retrieved March 20, 2023.

- "Ken Griffin donates $40 million to New York's Museum of Modern Art". Crain Communications. December 22, 2015. ISSN 1557-7902. Archived from the original on December 20, 2019.

- Kazakina, Katya (February 20, 2015). "Citadel's Griffin Gives $10 Million to Chicago Art Museum". Bloomberg News. Archived from the original on June 2, 2016.

- Sjostrom, Jan (August 9, 2018). "Billionaire Ken Griffin giving $20 million to Norton Museum in West Palm Beach". Palm Beach Daily News. Archived from the original on April 17, 2021. Retrieved April 17, 2021.

- Kent, Cheryl (December 19, 2012). "Fourth Presbyterian Church's new Gratz Center a welcome and brave grace note". Chicago Tribune. ISSN 2165-171X. Archived from the original on December 26, 2019.

- "Kenneth Griffin and Anne Dias Griffin timeline". Chicago Tribune. November 7, 2014. Archived from the original on April 11, 2021. Retrieved April 8, 2021.

- "$2 Million Gift from the Partners of Citadel and Citadel Securities to Fund New COVID-19 Advances at Weill Cornell Medicine | Giving to Weill Cornell Medicine". give.weill.cornell.edu. Archived from the original on November 23, 2021. Retrieved December 3, 2021.

- Lightfoot, Lori (March 19, 2020). Mayoral address concerning COVID-19 epidemic (Speech). Chicago. Archived from the original on March 19, 2020.

- Gill, Oliver (May 1, 2020). "Billionaire hedge fund backs British university hunt for Covid-19 vaccine". The Telegraph. ISSN 0307-1235. Archived from the original on November 22, 2021. Retrieved December 3, 2021.

- Lee, Allen (September 23, 2019). "20 Things You Didn't Know about Ken Griffin". Money Inc. Archived from the original on September 25, 2020. Retrieved August 12, 2020.

- Yerak, Becky (July 24, 2014). "Hedge fund billionaire Ken Griffin files for divorce". Chicago Tribune. Archived from the original on May 6, 2021. Retrieved April 4, 2021.

- Yerak, Becky; Marx, Ryan (October 7, 2015). "A breakdown of the Griffin breakup". Chicago Tribune. Archived from the original on December 10, 2017.

- Murphy, Tim (April 6, 2007). "Who Gets to Marry a Billionaire?". New York. Archived from the original on September 20, 2019.

- Stevenson, Alexandra; De La Merced, Michael (July 24, 2014). "A Divorce That Thrusts Ken Griffin and Anne Dias Griffin Into the Spotlight". The New York Times. ISSN 1553-8095. Archived from the original on November 7, 2017.

- Stevenson, Alexandra (October 7, 2015). "Kenneth Griffin and Anne Dias Griffin Settle Divorce Case". The New York Times. ISSN 0362-4331. Archived from the original on November 12, 2019.

- Frank, Robert (February 23, 2015). "$450,000 vacation? Billionaire divorce reveals big spending". CNBC. Archived from the original on October 26, 2020.

- Fox, Emily Jane (October 5, 2015). "Billionaire Ken Griffin Is Back in Court Fighting Over His Pre-Nup". Vanity Fair. Archived from the original on August 15, 2020.

- "Who won in the high-profile Griffin divorce?". Chicago Business. Crain Communications. October 7, 2015. Archived from the original on October 27, 2020.

- Yerak, Becky; Janssen, Kim (October 5, 2015). "Griffin divorce negotiations no surprise to experts". The Capital. Archived from the original on October 27, 2020.

- De La Merced, Michael J. (October 2, 2014). "Citadel's Griffin Outlines Terms of Prenuptial Agreement in Divorce Fight". The New York Times. Archived from the original on May 8, 2021. Retrieved April 4, 2021.

- Copeland, Rob (October 7, 2015). "Citadel's Ken Griffin Settles Divorce Case". The Wall Street Journal. Archived from the original on August 13, 2016.

- Kelly, Kate (October 22, 2014). "Citadel founder's divorce battle over property gets uglier". CNBC. Archived from the original on August 15, 2020.

- "Ken Griffin gives his side of the blowup in the bedroom". Chicago Business. Crain Communications. February 20, 2015. Archived from the original on December 26, 2019.

- Frank, Robert (October 23, 2014). "What Billionaires Really Spend Each Month". nbcnews.com. NBC News. Archived from the original on October 26, 2020.

- Frank, Robert (January 30, 2015). "$1 million a month to raise the kids". CNBC. Archived from the original on December 29, 2016.

- Peterson-Withorn, Chase (October 7, 2020). "Hedge Fund Billionaire Ken Griffin Settles Contentious Divorce". Forbes. Archived from the original on September 16, 2020.

- Merced, Michael J. de la (September 2, 2014). "Anne Griffin Seeks to Void Prenuptial Agreement With Ken Griffin". The New York Times. Archived from the original on October 9, 2020.

- Kapos, Shia (January 29, 2015). "Ken Griffin asks court to set trial date for divorce". Chicago Business. Crain Communications. Archived from the original on October 27, 2020.

- Yerak, Becky (January 30, 2015). "Billionaire's estranged wife allegedly demands 24/7 private jet". The Capital. Archived from the original on October 26, 2020.

- Kapos, Shia (February 13, 2015). "Anne Dias Griffin reveals days leading to prenup". Chicago Business. Crain Communications. Archived from the original on October 11, 2020.

- Herbst-Bayliss, Svea; Valdmanis, Richard (October 7, 2015). "Citadel's Kenneth Griffin settles divorce case". Reuters. Archived from the original on December 26, 2019.

- Goldsborough, Bob (November 5, 2015). "Ken Griffin pays ex-wife $11.75 million for Park Tower penthouse". Chicago Tribune. Archived from the original on October 26, 2020.

- Fox, Emily Jane (October 5, 2015). "Billionaire Ken Griffin Is Back in Court Fighting Over His Pre-Nup". Vanity Fair. Archived from the original on August 15, 2020.

- "Who won in the high-profile Griffin divorce?". Chicago Business. Crain Communications. October 7, 2015. Archived from the original on October 27, 2020. Retrieved August 12, 2020.

- Peterson-Withorn, Chase (October 7, 2015). "Hedge Fund Billionaire Ken Griffin Settles Contentious Divorce". Forbes. Archived from the original on September 16, 2020.

- Neate, Rupert (May 10, 2016). "Top 25 hedge fund managers earned $13bn in 2015 – more than some nations". The Guardian. Archived from the original on May 19, 2021. Retrieved April 8, 2021.

- Harris, Melissa (March 11, 2012). "Ken Griffin interview: Billionaire talks politics and money". Chicago Tribune. Archived from the original on December 19, 2019.

- "It's tougher to get a job at Citadel than to get into Harvard, says CEO Ken Griffin". American City Business Journals. November 19, 2015. Archived from the original on October 26, 2020.

- Elejalde-Ruiz, Alexia (April 12, 2016). "Ken Griffin, McDonald's among targets at Fight for $15's Chicago protests". Chicago Tribune. Archived from the original on May 17, 2021. Retrieved April 6, 2021.

- "Trump's First 100 Days Get a Warm Embrace from Ken Griffin". Institutional Investor. May 1, 2017. Archived from the original on August 12, 2018.

- RobertsJune 7, Ray; Pm, 2018 at 12:47 (June 7, 2018). "Chicago billionaire Ken Griffin named finance chair for Rick Scott's super PAC". Florida Politics - Campaigns & Elections. Lobbying & Government. Archived from the original on April 17, 2021. Retrieved April 17, 2021.

- Renninson, Joe (November 13, 2018). "Hedge fund billionaire Ken Griffin slams Trump for Fed criticism". Financial Times. Archived from the original on October 25, 2020.

- DeCambre, Mark. "Hedge-fund heavyweight Ken Griffin fears Trump knocks on Fed eroding faith in dollar". MarketWatch. Archived from the original on August 4, 2019.

- Shazar, Jon (November 14, 2018). "Jay Powell Can Always Go Work For Ken Griffin If This Fed Chair Thing Doesn't Work Out". Archived from the original on April 12, 2023. Retrieved October 17, 2020.

- "Elizabeth Warren". January 30, 2019. Archived from the original on October 26, 2020 – via Facebook.

- Rubenstein, David. The David Rubenstein Show: Ken Griffin. Archived from the original on August 21, 2019 – via YouTube.

- Donovan, Lisa (January 16, 2020). "At White House ceremony, President Trump calls out for no-show Chicago billionaire Ken Griffin: 'Where the hell is he?'". Chicago Tribune. Archived from the original on April 30, 2020.

- "Remarks by President Trump at Signing of the U.S.-China Phase One Trade Agreement". whitehouse.gov (Press release). January 15, 2020. Archived from the original on March 6, 2021. Retrieved February 25, 2021 – via National Archives.

- Griffin, Ken. "Commentary: Ken Griffin: Why I oppose the graduated income tax". Chicago Tribune. Archived from the original on September 7, 2020.

- Hinton, Rachel (September 4, 2020). "Deep-pockets dogfight? Billionaires Ken Griffin and Gov. Pritzker dig into wallets in battle over income tax". Chicago Sun-Times. Archived from the original on September 8, 2020.

- Pearson, Rick (October 24, 2020). "Battle of billionaires: Griffin slams Pritzker push for graduated income tax amendment in email to employees". Chicago Tribune. Archived from the original on October 23, 2020.

- "Ken Griffin goes off on JB Pritzker". Capitol Fax. Archived from the original on October 27, 2020.

- Orr, Leanna (October 28, 2020). "In Leaked Remarks Among Hedge Fund Managers, Citadel's Ken Griffin Opens Up on Taxes". Institutional Investor. Archived from the original on November 4, 2020. Retrieved November 2, 2020.

- Shazar, Jon (October 29, 2020). "Ken Griffin: Raise Taxes, Just, Like, Not On Me". Dealbreaker. Archived from the original on April 12, 2023. Retrieved November 2, 2020.

- Copeland, Rob (October 15, 2023). "Warning of 'Grave' Errors, Powerful Donors Push Universities on Hamas". The New York Times. ISSN 0362-4331. Retrieved October 16, 2023.

- Wallace, Gregory (February 26, 2015). "Billionaire GOP contributor maxes out in one day". CNN. Archived from the original on April 11, 2021. Retrieved April 6, 2021.

- Beckel, M. (November 16, 2011). "One-Time Obama Bundler Now Seeing Only Red". OpenSecrets. Archived from the original on February 24, 2021. Retrieved April 6, 2021.

- Kelly, Kate (December 9, 2015). "Hedge fund manager Ken Griffin backing Marco Rubio for president". CNBC. Archived from the original on April 14, 2021. Retrieved April 3, 2021.

- Janssen, Kim (December 10, 2015). "Ken Griffin, Illinois' richest man, throws financial muscle behind Rubio campaign". Chicago Tribune. Archived from the original on May 19, 2021. Retrieved April 6, 2021.

- Kelly, Kate (September 23, 2016). "Megadonors like Ken Griffin, Peter Thiel keep their wallets closed for Trump". CNBC. Archived from the original on May 19, 2021. Retrieved April 8, 2021.

- Pearson, Rick (May 17, 2017). "Ken Griffin gives Gov. Bruce Rauner's campaign record $20 million". Chicago Tribune. Archived from the original on April 17, 2021. Retrieved April 17, 2021.

- "1820 PAC PAC Donors". OpenSecrets. Archived from the original on September 27, 2020. Retrieved April 6, 2021.

- "Ken Griffin gives big to help Susan Collins in Maine". Crain Communications. October 13, 2020. Archived from the original on October 16, 2020.

- "Coalition To Stop The Proposed Tax Hike Amendment". Illinois Campaign for Political Reform. Archived from the original on November 5, 2020. Retrieved September 8, 2020.

- Hinton, Rachel (October 2, 2020). "One billionaire's 'Fair Tax' is another's 'catastrophic constitutional amendment' — Griffin-Pritzker checkbook rumble rages on". Chicago Sun-Times. Archived from the original on October 4, 2020.

- Pearson, Rick (October 3, 2020). "Billionaire Ken Griffin drops extra $26.7M against Pritzker's graduated-rate income tax amendment proposal. His total stands at more than $46.7M". Chicago Tribune. Archived from the original on October 3, 2020.

- Pearson, Rick (October 24, 2020). "Billionaire Ken Griffin, in battle with Gov. J.B. Pritzker over graduated-rate income tax amendment, ups his stake to $53.75 million to oppose it". Chicago Tribune. Archived from the original on October 24, 2020.

- De Lea, Brittany (September 9, 2020). "Billionaire Ken Griffin spends $20M to campaign against Illinois tax hikes". Fox Business. Archived from the original on April 20, 2021. Retrieved April 3, 2021.

- "Partisan Battle Over Supreme Court Race Could Exceed $6 Million In Spending". October 16, 2020. Archived from the original on October 18, 2020.

- Mansur, Sarah (October 15, 2020). "Partisan battle over state Supreme Court race could exceed $6 million in spending". Daily Herald. Archived from the original on October 17, 2020.

- Sollenberger, Roger (December 17, 2020). "This hedge-fund billionaire is a huge fan of Sen. Kelly Loeffler — but why?". Salon. Archived from the original on December 17, 2020. Retrieved December 18, 2020.

- "REPORT: Timing Of Hedge-Fund Billionaire's $2 Million Donation to Pro-Loeffler Super PAC Raises Conflict Of Interest Concerns". Democratic Senatorial Campaign Committee. December 17, 2020. Archived from the original on May 19, 2021. Retrieved April 6, 2021.

- Gordon, Amanda L. (March 25, 2021). "Griffin's Covid Year Had Planes, Palm Beach, Philanthropy". Bloomberg News. Archived from the original on March 26, 2021. Retrieved April 8, 2021.

- Thompson, Alex; Meyer, Theodoric (January 1, 2021). "Janet Yellen made millions in Wall Street, corporate speeches". Politico. Archived from the original on January 8, 2021. Retrieved April 9, 2021.

- Smith, Allan; Gomez, Henry J. (September 1, 2021). "Wealthy GOP donors flock to DeSantis as presidential speculation swirls". NBC News. Archived from the original on September 1, 2021. Retrieved September 1, 2021.

- "DeSantis top donor invests in COVID drug governor promotes". Associated Press. August 17, 2021. Archived from the original on September 5, 2021. Retrieved September 5, 2021.

- "AP: Top Donor Of Gov. Ron DeSantis Is Regeneron Investor". CBS News. August 21, 2021. Archived from the original on September 5, 2021. Retrieved September 5, 2021.

- Farrington, Brendan (August 17, 2021). "DeSantis top donor invests in COVID drug governor promotes". AP News. Archived from the original on March 20, 2023. Retrieved March 22, 2023.

- "EXPLAINER: The link between Florida Gov. Ron DeSantis and Regeneron". WFLA-TV. August 21, 2021. Archived from the original on September 5, 2021. Retrieved September 5, 2021.

- "DeSantis Promotes COVID Antibody Treatment as Site Opens in Pembroke Pines". NBC 6 South Florida. August 18, 2021. Archived from the original on August 18, 2021. Retrieved August 19, 2021.

- Schweers, Zac Anderson, John Kennedy and Jeffrey. "Florida Gov. DeSantis promotes Regeneron, a COVID-19 treatment connected to one of his largest donors". Sarasota Herald-Tribune. Archived from the original on August 19, 2021. Retrieved August 19, 2021.

{{cite web}}: CS1 maint: multiple names: authors list (link) - Farrington, Brendan. "DeSantis top donor invests in COVID drug governor promotes Archived February 10, 2022, at the Wayback Machine", ABC News (18 Aug 2021).

- Farrington, Brendan (August 21, 2021). "DeSantis top donor invests in COVID drug governor promotes". ABC News. Associated Press. Archived from the original on September 5, 2021. Retrieved September 5, 2021.

- Contorno, Steve. "As Florida targets Disney, some Republicans chafe at DeSantis' 'vengeful' and 'punitive' Reedy Creek move Archived March 20, 2023, at the Wayback Machine", CNN (6 May 2022).

- Pearson, Rick (November 10, 2021). "Battle of the billionaires rages on as Ken Griffin vows to go 'all in' to defeat Gov. J.B. Pritzker". Chicago Tribune. Archived from the original on December 7, 2021. Retrieved December 7, 2021.

- Ruskin, Liz. "Deep pockets aid Murkowski with attack ads on Tshibaka Archived July 21, 2022, at the Wayback Machine," Alaska Public Media, July 21, 2022. Retrieved July 21, 2022.

- "Schedule A Archived October 7, 2022, at the Wayback Machine," Federal Election Committee, July 21, 2022. Retrieved July 21, 2022.

- "Ken Griffin Donor Lookup OpenSecrets.org". OpenSecrets. Archived from the original on October 14, 2020.

- "Ken Griffin Contributions FEC". Federal Election Commission. Archived from the original on October 14, 2020.

- Lane, Mary (February 13, 2015). "Sotheby's Brushes Up Its Image With London Auction". The Wall Street Journal. ISSN 0099-9660. Archived from the original on December 20, 2019.

- Block, Fang (June 5, 2020). "Ken Griffin Buys a Jean-Michel Basquiat for More Than $100 Million". Barron's. Archived from the original on August 5, 2020.

- "Art Industry News: Hedge-Fund Manager Ken Griffin Just Bought One of Peter Brant's Basquiats for More Than $100 Million + Other Stories". Artnet. June 4, 2020. Archived from the original on October 26, 2020.

- Crow, Kelly; Germano, Sara (January 23, 2014). "New Masters of the Art Universe". The Wall Street Journal. ISSN 0099-9660. Archived from the original on December 18, 2019.

- Kazakina, Katya; Burton, Katherine (February 18, 2016). "Billionaire Griffin Pays $500 Million for Two Paintings". Bloomberg News. Archived from the original on March 8, 2020.

- Embuscado, Rain (February 18, 2016). "Billionaire Art Collector Ken Griffin Spends $500 Million on Two Paintings". Artnet. Archived from the original on February 20, 2016. Retrieved April 8, 2021.

- Kamp, Justin (June 5, 2020). "Hedge Fund Manager Ken Griffin Buys Basquiat Painting for More Than $100 Million". Artsy. Archived from the original on October 26, 2020.

- Johnson, Steve (July 25, 2020). "Now hanging at the Art Institute: Chicago billionaire Ken Griffin's new, $100 million Basquiat canvas". Chicago Tribune. Archived from the original on October 5, 2020.

- "Top 200 Collectors: KENNETH C. GRIFFIN". ARTnews. September 10, 2017. Archived from the original on April 17, 2021. Retrieved April 17, 2021.

- Clarke, Katherine (October 8, 2020). "How Citadel CEO Ken Griffin Built a $1 Billion Private Property Portfolio". The Wall Street Journal. ISSN 0099-9660. Archived from the original on October 9, 2020.

- Haughney, Christine (January 2, 2010). "In Real Estate Industry, Remembering a Year Worth Forgetting". The New York Times. ISSN 0362-4331. Archived from the original on January 7, 2010.

- David, Mark (May 12, 2009). "A Peep Into and A Poke Around 820 Fifth Avenue". Variety. Archived from the original on October 26, 2020.

- Bandell, Brian (December 18, 2020). "Billionaire's firm sells Faena House condo for $35M after discount (Photos)". American City Business Journals. Archived from the original on December 18, 2020. Retrieved April 8, 2021.

- Abramian, Alexandria (April 23, 2014). "Billionaires Descend on Hawaii's Big Island". Hollywood Reporter. Archived from the original on October 12, 2020.

- Goldman, Leah. "HOUSE OF THE DAY: Ken Griffin Buys A $17 Million Home In Hawaii". Business Insider. Archived from the original on October 26, 2020.

- Frank, Robert (October 4, 2015). "Ken Griffin goes on $290 million real estate spree". CNBC. Archived from the original on October 19, 2017.

- Goldsborough, Bob. "Billionaire exec Ken Griffin pays $58.75 million in Chicago area's priciest home sale ever". Chicago Tribune. Archived from the original on September 13, 2020.

- Rebong, Kevin (June 19, 2020). "Ken Griffin to Receive 2019 Tax Bill Totaling $1.3M at No. 9 Walton". The Real Deal. Archived from the original on October 9, 2020.

- Frank, Robert (January 22, 2019). "Billionaire Ken Griffin buys $122 million London mansion". CNBC. Archived from the original on October 1, 2020.

- "US hedge fund tycoon buys £95m house near Buckingham Palace". The Guardian. January 21, 2019. Archived from the original on October 23, 2020.

- "With $122 million London purchase, Ken Griffin has spent at least $724 million on homes". Crain Communications. January 21, 2019. Archived from the original on August 6, 2020.

- Clarke, Katherine (January 23, 2019). "Billionaire Ken Griffin Buys America's Most Expensive Home for $238 Million". The Wall Street Journal. ISSN 0099-9660. Archived from the original on December 29, 2019.

- "2019's top 10 home sales broke the billion dollar mark". Crain Communications. December 26, 2019. Archived from the original on April 3, 2020.

- Stewart, Nikita; Gelles, David (January 24, 2019). "The $238 Million Penthouse, and the Hedge Fund Billionaire Who May Rarely Live There". The New York Times. ISSN 0362-4331. Archived from the original on September 9, 2020.

- Yale, Aly J. (February 22, 2019). "Pied-A-Terre Tax Debate Reignited After Billionaire Ken Griffin's $238 Million Penthouse Purchase". Forbes. Archived from the original on September 20, 2020.

- "'Class warfare': NYC's proposed pied-a-terre tax signals a shift—and casts a chill". Crain Communications. Bloomberg News. March 15, 2019. Archived from the original on October 12, 2020.

- Hofheinz, Darrell (August 31, 2021). "$85 million and up: Top 10 most expensive homes in Palm Beach. 2 have a Trump tie". The Palm Beach Post. Archived from the original on September 14, 2021. Retrieved September 14, 2021.

- Hofheinz, Darrell (January 28, 2021). "Billionaire Griffin's new house unveiled, proposed for part of South End estate in Palm Beach". Palm Beach Daily News. Archived from the original on May 14, 2021. Retrieved April 9, 2021.

- "Most Expensive Hamptons Home Sales in 2020". December 21, 2020.

- Kallergis, Katherine (December 4, 2020). "Ken Griffin adds to Star Island assemblage with $25M purchase: sources". The Real Deal. Archived from the original on May 19, 2021. Retrieved April 9, 2021. Note: High-quality sources are behind paywalls in the Miami Herald and WSJ.

- Bandell, Brian (May 27, 2022). "Coral Gables mansion sells for $45M to firm associated with billionaire amid legal battle". American City Business Journals. Archived from the original on May 27, 2022. Retrieved June 25, 2022.

- Huddleston Jr., Tom (March 7, 2020). "This hedge fund billionaire owns the most expensive home ever sold in America — here's how he spends his fortune". CNBC. Archived from the original on July 13, 2022. Retrieved April 8, 2021.

- "Hedge Fund King Sued By Self-Described Mentor". The Wall Street Journal. June 14, 2006. Archived from the original on June 25, 2022. Retrieved June 25, 2022.

- "Full Case Electronic Docket Search | Clerk of the Circuit Court of Cook County". casesearch.cookcountyclerkofcourt.org. Archived from the original on May 24, 2022. Retrieved May 23, 2022.

- Kirk, Jim (January 22, 2007). "Lawsuit no longer looms for Citadel". Chicago Tribune. Archived from the original on June 25, 2022. Retrieved June 25, 2022.

- Vickers, Marcia (April 3, 2007). "Citadel's Griffin: Hedge fund superstar (cont.)". Fortune.

- Esposito, Stefano (September 12, 2023). "Ken Griffin, a character in 'Dumb Money,' slams movie's 'false implications and inaccuracies'". Chicago Sun-Times.

- Breznican, Anthony (June 21, 2023). "'Dumb Money' First Look: The GameStop Stock Frenzy Is Now a Movie". Vanity Fair.

Further reading

- Peltz, Lois (March 2009). The New Investment Superstars. Wiley. ISBN 978-0-471-40313-5.

- The Quants, Scott Patterson, Crown Publishing Group, February 2, 2010

- Ken Griffin's rise to power, CNBC, May 15, 2015