Income–consumption curve

In economics and particularly in consumer choice theory, the income-consumption curve (also called income expansion path and income offer curve) is a curve in a graph in which the quantities of two goods are plotted on the two axes; the curve is the locus of points showing the consumption bundles chosen at each of various levels of income.

| Part of a series on |

| Economics |

|---|

The income effect in economics can be defined as the change in consumption resulting from a change in real income.[1] This income change can come from one of two sources: from external sources, or from income being freed up (or soaked up) by a decrease (or increase) in the price of a good that money is being spent on. The effect of the former type of change in available income is depicted by the income-consumption curve discussed in the remainder of this article, while the effect of the freeing-up of existing income by a price drop is discussed along with its companion effect, the substitution effect, in the article on the latter. For example, if a consumer spends one-half of his or her income on bread alone, a fifty-percent decrease in the price of bread will increase the free money available to him or her by the same amount which he or she can spend in buying more bread or something else

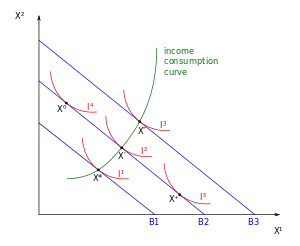

The consumer's preferences, monetary income and prices play an important role in solving the consumer's optimization problem (choosing how much of various goods to consume so as to maximize their utility subject to a budget constraint). The comparative statics of consumer behavior investigates the effects of changes in the exogenous or independent variables (especially prices and money incomes of the consumers) on the chosen values of the endogenous or dependent variables (the consumer's demands for the goods). When the income of the consumer rises with the prices held constant, the optimal bundle chosen by the consumer changes as the feasible set available to them changes. The income–consumption curve is the set of tangency points of indifference curves with the various budget constraint lines, with prices held constant, as income increases shifting the budget constraint out.

Consumer theory

The income effect is a phenomenon observed through changes in purchasing power. It reveals the change in quantity demanded brought by a change in real income. The figure 1 on the left shows the consumption patterns of the consumer of two goods X1 and X2, the prices of which are p1 and p2 respectively. The initial bundle X*, is the bundle which is chosen by the consumer on the budget line B1. An increase in the money income of the consumer, with p1 and p2 constant, will shift the budget line outward parallel to itself.

In the figure, this means that the change in the money income of the consumer will shift the budget line B1 outward parallel to itself to B2 where the bundle X' bundle will be chosen. Again, an increase in the money income of the consumer will push the budget line B2 outward parallel to itself to B3 where the bundle X" will be the bundle which will be chosen. Thus, it can be said that, with variations in income of the consumers and with the prices held constant the income–consumption curve can be traced out as the set of optimal points.

For different types of goods

In the case illustrated with the help of Figure 1 both X1 and X2 are normal goods in which case, the demand for the good increases as money income rises. However, if the consumer has different preferences, he has the option to choose X0 or X+ on budget line B2. As the income of the consumer rises, and the consumer chooses X0 instead of X' i.e. if the consumer's indifference curve is I4 and not I2, then the demand for X1 would fall . In that case, X1 would be called an inferior good i.e. demand for good X1 decreases with a rise in income of the consumer. Thus, a rise in income of the consumer may lead his demand for a good to rise, fall or not change at all. It is important to note here that, the knowledge of preferences of the consumer is essential to predict whether a particular good is inferior or normal.

Normal goods

.svg.png.webp)

In the figure 2 to the left, B1, B2 and B3 are the different budget lines and I1, I2 and I3 are the indifference curves that are available to the consumer. As shown earlier, as the income of the consumer rises, the budget line moves outwards parallel to itself. In this case, from initial bundle X*, with an increase in the income of the consumer the budget line moves from B1 to B2 and the consumer would choose X' bundle and subsequently, with a further rise in consumer's income the budget line moves from B2 to B3 and the consumer would choose X" bundle and so on. The consumer would thus maximize his utility at the points X*, X' and X", and by joining these points, the income-consumption curve can be obtained.

Inferior goods

.svg.png.webp)

The figure on the right (figure 3), shows the consumption patterns of the consumer of two goods X1 and X2, the prices of which are p1 and p2 respectively, where B1 and B2 are the budget lines and I1 and I2 are the indifference curves. Figure 3 clearly shows that, with a rise in the income of the consumer, the initial budget line B1 moves outward parallel to itself to B2 and the consumer now chooses X' bundle to the initial bundle X*. The figure shows that, the demand for X2 has risen from X21 to X22 with an outward shift of the budget line from B1 to B2 (caused due to rise in the income of the consumer). This essentially means that, good X2 is a normal good as the demand for X2 rose with an increase in the income of the consumer.

In contrast, it is to be noted from the figure, that the demand for X1 has fallen from X11 to X12 with an outward shift of the budget line from B1 to B2 (caused due to rise in the income of the consumer). This implies that, good X1 is an inferior good as the demand for X1 fell with an increase in the income of the consumer.

The consumer maximizes his utility at points X* and X' and by joining these points, the income–consumption curve can be obtained.[2] In figure 3, the income–consumption curve bends back on itself as with an increase income, the consumer demands more of X2 and less of X1.[3] The income–consumption curve in this case is negatively sloped and the income elasticity of demand will be negative.[4] Also the price effect for X2 is positive, while it is negative for X1.[3]

is the change in the demand for good 1 when we change income from to , holding the price of good 1 fixed at :

Engel curves

See also

- Consumer theory § Income effect

- Expansion path, the closest analog in production theory

References

- O'Sullivan, Arthur; Sheffrin, Steven M. (2003). Economics: Principles in Action. Upper Saddle River: Pearson Prentice Hall. p. 80. ISBN 0-13-063085-3.

- Salvatore, Dominick. Microeconomics (PDF). Archived from the original (PDF) on October 20, 2012.

- Application of Indifference Curve Analysis Archived December 27, 2019, at the Wayback Machine, EconomicsConcepts.com, retrieved April 25, 2017.

- Rubinfeld, Daniel; Pindyck, Robert (1995). Microeconomics. Mainland China: Tsinghua University Press/Prentice-Hall. p. 98. ISBN 7-302-02494-4.

External links

Media related to Income consumption curves at Wikimedia Commons

Media related to Income consumption curves at Wikimedia Commons- "income effect". BusinessDictionary. Archived from the original on April 23, 2019. Retrieved August 10, 2019.