Environmental finance

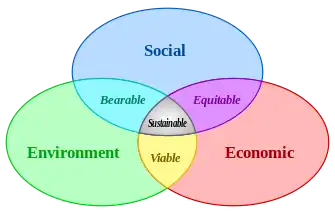

Environmental finance is a field within finance that employs market-based environmental policy instruments to improve the ecological impact of investment strategies.[1] The primary objective of environmental finance is to regress the negative impacts of climate change through pricing and trading schemes.[2] The field of environmental finance was established in response to the poor management of economic crises by government bodies globally.[3] Environmental finance aims to reallocate a businesses resources to improve the sustainability of investments whilst also retaining profit margins.[2]

| Part of a series about |

| Environmental economics |

|---|

|

History

In 1992, Richard L. Sandor proposed a new course outlining emission markets at the University of Chicago Booth School of Business, that would later be known as the course, Environmental Finance. Sandor anticipated a social shift in perspectives on the effects of global warming and wanted to be on the frontier of new research.[2]

Prior to this in 1990, Sandor had been involved with the passing of the Clean Air Act Amendment for the Chicago Board of Trade, which aimed to reduce high sulfur dioxide levels following WW2. Inspired by the theory of social cost, Sandor focused on cap-and-trade strategies such as emission trading schemes and more flexible mechanisms including taxes and subsidies to manage environmental crisis. The implementation of cap-and-trade mechanisms was a contributing factor to the success of the Clean Air Act Amendment.[2]

Following the Clean Air Act in 1990, the United Nations Conference on Trade and Development approached the Chicago Board of Trade in 1991, to enquire about how the market-based instruments used to combat high atmospheric sulfur dioxide concentrations could be applied to the increasing levels of atmospheric carbon dioxide. Sandor created a framework consisting of four characteristics which could be used to describe the carbon market:[2]

- Standardisation

- Unit Trading

- Price Basis

- Delivery

In 1997 the Kyoto Protocol was enacted and later enforced in 2005 by the United Nations Framework Convention on Climate Change. Included nations agreed to focus on reducing global greenhouse gas emissions through the market-based mechanism of emissions trading. Reductions averaged approximately 5% by 2012 which equates to almost 30% in reduction of total emissions. Some nations made significant progress under the Kyoto protocol, however as it only became law in 2005, nations such as the United States and China reported increased emissions, substantially offsetting progress made by other regions.[4]

In 1999, the Dow Jones Sustainability Index was introduced to evaluate the ecological and social impact of stocks so shareholders could invest more ethically. The index acts as an incentive for firms to improve their environmental footprint to attract more shareholders.[5]

Later in 2000, the United Nations introduced the Millennium Development Goal scheme which sought to promote a sustainable framework for large multinational corporations and countries to follow to improve the environmental impact of financial investments. This framework facilitated the development of the United Nations Sustainable Development Goal scheme in 2015, which aimed to increase funding environmentally responsible investments in developing nations.[6] Funding was targeted to improve areas such as primary education, gender equality, maternal health, and nutrition, with the overall goal of creating beneficial national relationships to decrease the ecological footprint of developing economies[7]. Implementation of these frameworks has promoted greater participation and accountability of corporate environmental sustainability, with over 230 of the largest global firms reporting their sustainability metrics to the United Nations.[6]

The United Nations Environment Program (UNEP) has had a detailed history in providing infrastructure to improve the environmental effects of financial investments. In 2004, the institute provided training on responsible environmental credit budgeting and management for Eastern European nations. Following the Global Financial Crisis beginning in 2007, the UNEP provided substantial support for future sustainable investment choices for economies such as Greece which were impacted severely.[7] The Portfolio Decarbonisation Coalition established in 2014 is a significantly notable initiative in the history of environmental finance as it aims to establish an economy that is not dependent on investments with large carbon footprints. This goal is achieved through large-scale stakeholder reinvestment and securing long-term, responsible, investment commitments.[8] Most recently, the UNEP has recommended OECD nations to align investment strategies alongside the objectives of the Paris Agreement, to improve long-term investments with significant ecological effects.[7]

In 2008 the Climate Change Act enacted by the UK Government established a framework to limit greenhouse gasses and carbon emissions through a budgeting scheme, which motivated firms and businesses to reduce their carbon output for a financial reward.[9] Specifically, by 2050 it seeks to reduce carbon emissions by 80% compared to levels in 1980. The Act seeks to achieve this goal by reviewing carbon budgeting schemes such emission trading credits, every 5 years to continually reassess and recalibrate relevant policies. The cost of reaching the 2050 goal has been estimated at approximately 1.5% of GDP, although the positive environmental impact of reducing carbon footprint and increased in investment into the renewable energy sector will offset this cost.[10] A further implicated cost in the pursuit of the Act is a predicted £100 increase in annual household energy costs, however this price increase is set to be outweighed by an improved energy efficiency which will decrease fuel costs.[11]

The 2010 cap and trade scheme introduced in the metropolitan regions of Tokyo was mandatory for businesses heavily dependent on fuel and electricity, who accounted for almost 20% of total carbon emissions in the area. The scheme aimed to reduce emissions by 17% by the end of 2019.[12]

In 2011 the Clean Energy Act was enacted by the Australian Government. The act introduced the Carbon Tax which aimed to reduce greenhouse gas emission by charging large firms for their carbon tonnage. The Clean Energy Act facilitated the transition to an emissions trading scheme in 2014[13]. The scheme also aims to fulfill the Australian Government's obligations in respect to the Kyoto Protocol and the Climate Change Convention. Additionally, the Act seeks to reduce emissions in a manner that will foster economic growth through increased market competition and investment into renewable energy sources.[12] The Australian National Registry of Emissions Units regulates and monitors the use of emission credits utilised by the Act. Firms must enroll in the registry to buy and sell credits to compensate for their relevant reduction or over-consumption of carbon emissions.[14]

The Republic of Korea's 2015 emission trading scheme aims to reduce carbon emissions by 37% by 2030. It strives to achieve this through allocating a quota of carbon emission to the largest carbon emitting businesses, resetting at the beginning of the schemes 3 separate phases.[15]

In 2017 the National Mitigation Plan was passed by the Irish Government which aimed to regress climate change by decreasing emission levels through revised investment strategies and frameworks for power generation, agriculture, and transport The plan involves 106 separate guidelines for short and long term climate change mitigation.[16]

The European Union Emission Trading Scheme concluding at the end of 2020 is the longest single global carbon pricing scheme, which has been improved over its three 5-year phases.[17] Current improvements include a centralised emission credit trading system, auctioning of credits, addressing a broader range of green house gasses and the introduction of a European-wide credit cap instead of national caps.

Strategies

Societal shifts from fossil fuels to renewable energy caused by an increased awareness of climate change has made government bodies and firms re-evaluate investment strategies to avoid irreparable ecological damage.[18] Shifts away from fossil fuels also increase demand into alternate energy sources which requires revised investment strategies.[18]

The initial stage to mitigate climate change through financial tools involves ecological and economic forecasting to model future impacts of current investment methodologies on the environment.[19] This allows for an approximate estimation of future environments; however, the impacts of continued harmful business trends need to be observed under a non-linear perspective.[3]

Cap-and-trade mechanisms limit the total amount of emissions a particular region or country can emit. Firms are issued with tradeable permits which they can buy or sell. This acts as a financial incentive to reduce emissions and as a disincentive to exceed emission caps.[1]

In 2005, the European Union Emission Trading Scheme was established and is now the largest emission trading scheme globally.[1]

In 2013, the Québec Cap-and-trade scheme was established and is currently the primary mitigation strategy for the area.[20]

Direct foreign investment into developing nations provide more efficient and sustainable energy sources.[1]

In 2006, the Clean Development Mechanism was formed under the Kyoto Protocol, providing solar power and new technologies to developing nations. Countries who invest into developing nations can receive emission reduction credits as a reward.[21]

Removal of atmospheric carbon dioxide has been proposed as a solution to mitigate climate change, by increasing tree densities to absorb carbon dioxide. Other methods involve new technologies which are still in research development stages.[22]

Research in environmental finance has sought how to strategically invest in clean technologies. When paired with international legislation, such as the case of the Montreal Protocol on Substances that Deplete the Ozone Layer, environmentally based investments have stimulated emerging industries and reduced the consequences of climate change. The international collaboration would ultimately lead to the changes that repaired the hole in the ozone layer.[23]

Climate finance

| Part of a series on |

| Climate change and society |

|---|

Climate finance are funding processes for investments related to climate change mitigation and adaptation. The term has been used in a narrower sense to refer to transfers of public resources from developed to developing countries, in light of their UN Climate Convention obligations to provide "new and additional financial resources". In a wider sense, the term refers to all financial flows relating to climate change mitigation and adaptation.[25][26]

The 21st session of the Conference of Parties (COP) to the UNFCCC (Paris 2015) introduced a new era for climate finance, policies, and markets. The Paris Agreement adopted there defined a global action plan to put the world on track to avoid dangerous climate change by limiting global warming to well below 2 °C above preindustrial levels. It includes climate financing channeled by national, regional and international entities for climate change mitigation and adaptation projects and programs. They include climate specific support mechanisms and financial aid for mitigation and adaptation activities to spur and enable the transition towards low-carbon, climate-resilient growth and development through capacity building, R&D and economic development.[27]

As of November 2020, development banks and private finance had not reached the US$100 billion per year investment stipulated in the UN climate negotiations for 2020.[28] However, in the face of the COVID-19 pandemic's economic downturn, 450 development banks pledged to fund a "Green recovery" in developing countries.[28]Impact

The European Union Emission Trading Scheme from 2008-2012 was responsible for a 7% reduction in emissions for the states within the scheme. In 2013, allowances were reviewed to accommodate for new emission reduction targets. The new annual recommended target was a reduction of 1.72%.[1] It is estimated that reducing the amount of quoted credits was restricted more tightly, emissions could have been reduced by a total of 25%.[17] Nations such as Romania, Poland and Sweden experienced significant revenue, benefiting from selling credits. Despite successfully reducing emissions, the European Union Emission Trading Scheme has been critiqued for its lack of flexibility to accommodate to major shifts in the economic landscape and reassess currents contexts to provide a revised cap on trading credits, potentially undermining the original objective of the scheme.[29]

The New Zealand Emissions Trading Scheme of 2008 was modelled to increase annual household energy expenditure to 0.8% and increase fuel prices by approximately 6%. The price of agricultural products such as beef and dairy were modelled to decrease by almost 1%. Price increases in carbon intensive sectors such as foresting and mining were also expected, incentivising a shift towards renewable energy system and improved investment strategies with a less harmful environmental impact.[30]

In 2016, the Québec Cap-and-trade scheme was responsible for an 11% reduction in emissions compared to 1990 emission levels[20]. Due to the associated increased energy costs, fuel prices rose 2-3 cents per litre over the duration of the cap and trade scheme.[20]

In 2014, the Clean Development Mechanism was responsible for a 1% reduction in global greenhouse gas emissions.[31] The Clean Development Mechanism has been responsible for removing 7 billion tons of greenhouse gasses from the atmosphere through the efforts of almost 8000 individual projects. Despite this success, as the economies of developing nations participating in Clean Development Mechanisms improves, the financial payout to the country supplying such infrastructure increases at a greater rate than economic growth, thus leading to an unoptimised and counterproductive system.[32]

References

- Chesney, Marc; Gheyssens, Jonathan; Pana, Anca Claudia; Taschini, Luca (2016). Environmental Finance and Investments. Springer Texts in Business and Economics. doi:10.1007/978-3-662-48175-2. ISBN 978-3-662-48174-5.

- Sandor, Richard L. (2012). Sandor, Richard L (ed.). Good Derivatives: A Story of Financial and Environmental Innovation. John Wiley & Sons. doi:10.1002/9781119201069. ISBN 978-0-470-94973-3.

- Linnenluecke, Martina K.; Smith, Tom; McKnight, Brent (December 2016). "Environmental finance: A research agenda for interdisciplinary finance research". Economic Modelling. 59: 124–130. doi:10.1016/j.econmod.2016.07.010.

- "What is the Kyoto Protocol?". unfccc.int. Retrieved 2023-07-12.

- "DJSI Index Family - Pure Play Asset Management". S&P Global. 2020.

- "Green Business: Evolution of sustainable finance". Standard Chartered. Retrieved 2023-07-12.

- "The Evolution of Sustainable Finance". UNEP Finance Initiative. June 6, 2017.

- "What is climate mainstreaming?". www.mainstreamingclimate.org. Retrieved 2023-07-12.

- "Climate Change Act 2008". Retrieved 2023-07-12.

- Pearce, Rosamund (2016-12-16). "UK Climate Change Act: Understanding the costs and benefits". Carbon Brief. Retrieved 2023-07-12.

- Change, Extract from The Rough Guide to Climate (2011-03-11). "What is the Kyoto protocol and has it made any difference?". The Guardian. ISSN 0261-3077. Retrieved 2023-07-12.

- Talberg, A.; Swoboda, K. (June 6, 2013). "Emissions trading schemes around the world". Parliament of Australia.

- "The Carbon Tax in Australia". Centre For Public Impact (CPI). Retrieved 2023-07-12.

- "The Australian National Registry of Emissions Units (ANREU) - Emissions-EUETS.com". emissions-euets.com. Retrieved 2023-07-12.

- Kim, Ellie Jimin (2020-03-19). "East Asia's First Mandatory Emissions Trading System". Climate Scorecard. Retrieved 2023-07-12.

- "National Mitigation Plan - Climate Change Laws of the World". climate-laws.org. Retrieved 2023-07-12.

- Laing, Tim; Sato, Misato; Grubb, Michael; Comberti, Claudia (January 2013). Assessing the effectiveness of the EU Emissions Trading System (Report). CiteSeerX 10.1.1.365.6508. ProQuest 1698743158.

- Ding, Ashley; Daugaard, Dan; Linnenluecke, Martina K. (March 2020). "The future trajectory for environmental finance: planetary boundaries and environmental, social and governance analysis". Accounting & Finance. 60 (1): 3–14. doi:10.1111/acfi.12599. S2CID 213576271.

- White, Mark A. (1996). "Environmental Finance: Value and Risk in an Age of Ecology". Business Strategy and the Environment. 5 (3): 198–206. doi:10.1002/(SICI)1099-0836(199609)5:3<198::AID-BSE66>3.0.CO;2-4.

- "The cap-and-trade system in Québec". Centre For Public Impact (CPI). Retrieved 2023-07-12.

- "The Clean Development Mechanism". unfccc.int. Retrieved 2023-07-12.

- Cho, R. (2019). “Can Removing Carbon from the Atmosphere Save Us from Climate Catastrophe?” State of the Planet. https://blogs.ei.columbia.edu/2018/11/27/carbon-dioxide-removal-climate-change/

- Linnenluecke, Martina K.; Smith, Tom; McKnight, Brent (2016-12-01). "Environmental finance: A research agenda for interdisciplinary finance research". Economic Modelling. 59: 124–130. doi:10.1016/j.econmod.2016.07.010. ISSN 0264-9993.

- "World Energy Investment 2023 / Overview and key findings". International Energy Agency (IEA). 25 May 2023. Archived from the original on 31 May 2023.

Global energy investment in clean energy and in fossil fuels, 2015-2023 (chart)

— From pages 8 and 12 of World Energy Investment 2023 (archive). - Oscar Reyes (2013), "A Glossary of Climate Finance Terms", Institute for Policy Studies, Washington DC, p. 10 and 11

- "Search | Eldis".

- Barbara Buchner, Angela Falconer, Morgan Hervé-Mignucci, Chiara Trabacchi and Marcel Brinkman (2011) "The Landscape of Climate Finance" A CPI Report, Climate Policy Initiative, Venice (Italy), p. 1 and 2.

- "Banks around world in joint pledge on 'green recovery' after Covid". the Guardian. 2020-11-11. Retrieved 2020-11-12.

- Abdel-Ati, Ibrahim (2020-03-11). "The EU Emissions Trading System Seeking to Improve". Climate Scorecard. Retrieved 2023-07-12.

- Ministry for the Environment New Zealand (MFENZ). (2008). “7 The Impacts of the Emissions Trading Scheme.” The framework for a New Zealand Emissions Trading Scheme. https://www.mfe.govt.nz/publications/climate-change/framework-new-zealand-emissions-trading-scheme/7-impacts-emissions

- Warnecke, C., Day T., Tewari, R. (2015), “Impact of the Clean Development Mechanism.” New Climate Institute.

- Stahlke, Theresa (January 2020). "The impact of the Clean Development Mechanism on developing countries' commitment to mitigate climate change and its implications for the future". Mitigation and Adaptation Strategies for Global Change. 25 (1): 107–125. doi:10.1007/s11027-019-09863-8. S2CID 198632560.