2006 United Kingdom budget

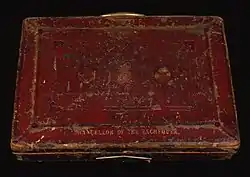

The 2006 United Kingdom Budget, officially known as Budget 2006: A strong and strengthening economy: Investing in Britain's future was formally delivered by Chancellor of the Exchequer Gordon Brown in the House of Commons on 22 March 2006.

| |

| Presented | 22 March 2006 |

|---|---|

| Parliament | 54th |

| Party | Labour |

| Chancellor | Gordon Brown |

| Total revenue | £516 billion‡[1] |

| Total expenditures | £552 billion‡[1] |

| Website | archived website |

| ‡Numbers in italics are projections.

‹ 2005 2007 › | |

Details

Taxes

| Receipts | 2006-07 Revenues (£bn) |

|---|---|

| Income Tax | 144 |

| National Insurance | 90 |

| Value Added Tax (VAT) | 76 |

| Corporate Tax | 49 |

| Excise duties | 40 |

| Council Tax | 22 |

| Business rates | 21 |

| Other | 74 |

| Total Government revenue | 516 |

Spending

| Department | 2006-07 Expenditure (£bn) |

|---|---|

| Social protection | 151 |

| Health | 96 |

| Education | 73 |

| Debt interest | 27 |

| Defence | 29 |

| Public order and safety | 32 |

| Personal social services | 26 |

| Housing and Environment | 19 |

| Transport | 21 |

| Industry, agriculture and employment | 21 |

| Other | 57 |

| Total Government spending | 552 |

References

- "Budget 2006, A strong and strengthening economy: Investing in Britain's future" (PDF). HM Treasury. Archived from the original (PDF) on 2008-09-10. Retrieved 2016-03-27.

This article is issued from Wikipedia. The text is licensed under Creative Commons - Attribution - Sharealike. Additional terms may apply for the media files.