Hattha Kaksekar

Hattha Kaksekar Limited or HKL (translated literally from the Khmer, "Farmer's Hand" or "A Helping Hand for Farmers") is a microfinance institution and a deposit-taking institution in Cambodia. In terms of loan portfolio, HKL is ranked fourth and it has the third largest saving portfolio among Cambodia MFIs.[1]

History

HKL is a former food security project launched in the Pursat Province in Cambodia by OCSD/Oxfam–Quebec in 1994. It was registered as an NGO with the Ministry of Interior in 1996. In 2001, Hattha Kaksekar Limited was born after it registered to the Ministry of Commerce with an overall capital of $77,850 and was offered a three-years MFI license. When it reached sustainability, the National Bank of Cambodia granted a permanent license to HKL in 2007 and a Micro-finance deposit-taking institution license in 2011.[2]

Clients

Concerning its customer base, 66%[3] of HKL's clients live in the countryside. According to a Microfinanza rating report, 40%[4] of its lending activities funded agricultural projects in 2011.

In 2013, women clients represented 60 to 80%[5] of overall customers.

HKL has launched products for Small and Medium Enterprises (SMEs) and Micro-Small and Medium Enterprises (MSMEs).[6]

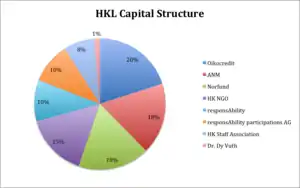

Capital structure

In September 2016, Krungsri entered Cambodia with the acquisition of Hattha Kaksekar, the country's fourth largest microfinance institution.[7]

HKL has previous eight shareholders:

- Oikocredit is the first private investor in microfinance. It funds trade cooperatives and SMEs and it bolsters small businesses through MFIs.

- ANM Fund[8] is a Dutch-based mutual fund for microfinance.

- Norfund, Norwegian state-owned fund, invests in financial institutions, SME investment funds, renewable energies and agriculture.

- HK NGO is the former food security project that was restructured and became a shareholder of HKL.

- responsAbility Participations AG[9] is an investment stock corporation from Switzerland. It invests mostly in financial institution in the developing world.

- responsAbility Investments AG[10] is an asset manager specialized in sectors related to development.

- HKL staff is an association that gathers all staff members who bought HKL shares.

- Dr. Dy Davuth is a personal investor who has experience in microfinance, administration and business development.

Branch network

In December 2014, HKL office network accounted for 151 offices mainly in rural areas spread among 25 provinces.[11]

Products

Loans

Creditworthiness, loan size and loan currency are the criteria on which interest rates setting is based. Concerning the use of the loan, supporting business activities or personal consumption can both be funded. In 2013, new products were launched: Green loans and Khmer Student loans.[12]

Savings and Deposit

The MFI developed three types of accounts:

- Voluntary savings: savings accounts and VIP accounts.

- Recurrent savings: Planned savings accounts, Kid and retirement accounts.

- Fixed deposits: a form of capitalization designed for high income. Clients can also use this product for charity purpose.

Money Transfer

National money transfers to family, relatives or business partners transit via HKL branch network.

ATMs

Launched at the end of 2012, ATM network accounted for 38 machines in Cambodia in August 2013.[13] It allows customers to perform cash and non-cash transactions.

MyMobile Banking

Mobile banking services allow customers to perform transactions such as inquiries about an account balance, look-up for an ATM location, mobile top up, bill payments and transfer funds. In addition, HKL has launched SMS notifications.

References

- NIX Data, March 2014, CMA website

- "Hattha Kaksekar - Norfund". Norfund.no. Archived from the original on 2013-01-29. Retrieved 2014-07-23.

- "HKL, Hattha Kaksekar Ltd - Développement économique de l'un des pays les plus pauvres du monde - Oikocredit France". Oikocredit.fr. Retrieved 2014-07-23.

- "Archived copy" (PDF). Archived from the original (PDF) on 2014-08-08. Retrieved 2014-07-31.

{{cite web}}: CS1 maint: archived copy as title (link) - "Hattha Kaksekar Limited - MFTransparency.org Truth In Lending Tables". Mftransparency.org. 2013-03-20. Retrieved 2014-07-23.

- "Hattha Kaksekar Ltd. | MFIs in Cambodia". Mixmarket.org. Retrieved 2014-07-23.

- "Bank of Ayudhya evolving into first tier regional player under Japan's BTMU". Nikkei Asian Review. Retrieved 2019-11-17.

- "Triple Jump.eu: Microfinance Investment Management and Advisory Services - ASN-Novib Microcredit Fund". Archived from the original on February 9, 2014. Retrieved July 31, 2014.

- "Media releases - Media releases - responsAbility Participations AG - Capital increase successfully completed". responsAbility. Retrieved 2014-07-23.

- "Investing - responsAbility news". responsAbility. 2014-07-14. Retrieved 2014-07-23.

- "Hattha Kaksekar Limited". Hkl.com.kh. Archived from the original on 2014-08-03. Retrieved 2014-07-23.

- "Hattha Kaksekar Ltd. | MFIs in Cambodia". Mixmarket.org. 1994-05-01. Retrieved 2014-07-23.

- "Hattha Kasekar Limited (HKL) added more 16 ATMs in Cambodia | The Association of Banks in Cambodia". Abc.org.kh. Archived from the original on 2014-08-08. Retrieved 2014-07-23.