Warren Hellman

F. Warren Hellman (July 25, 1934 – December 18, 2011) was an American billionaire investment banker and private equity investor, the co-founder of private equity firm Hellman & Friedman.[1] Hellman also co-founded Hellman, Ferri Investment Associates, today known as Matrix Partners. He started and funded the Hardly Strictly Bluegrass festival.[2] Hellman died on December 18, 2011, of complications from his treatment for leukemia.[3]

Warren Hellman | |

|---|---|

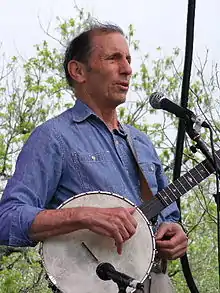

Hellman at Old Settler's Music Festival in Driftwood, TX (2010). | |

| Born | July 25, 1934 New York City |

| Died | December 18, 2011 (aged 77) San Francisco, California |

| Citizenship | United States |

| Education | University of California, Berkeley (BA, 1955) Harvard University (MBA, 1959) |

| Occupation(s) | Private equity, Investment banking (prior) |

| Employer | Hellman & Friedman |

| Known for | Founder of Hellman & Friedman, Hellman, Ferri Investment Associates (today Matrix Partners) |

| Spouse | Patricia Christina Sander |

| Children | Marco Hellman Frances Hellman Judith Hellman Patricia Hellman Gibbs |

| Parent(s) | Ruth Koshland Marco Hellman |

| Family | Isaias W. Hellman (great-grandfather) |

Early life and education

Frederick Warren Hellman was born to a Jewish family[4][5] in New York and spent his early childhood in Manhattan.[6] The son of Ruth (née Koshland)[7] and Marco "Mick" Hellman,[6] he was the great-grandson of banker and philanthropist Isaias W. Hellman.[8] During World War II, his family moved to Vacaville, California, where his father served as a Major in the Army and his mother worked as a Women Airforce Service Pilot, flying military planes from aircraft factories to bases.[6] After the war, they moved to San Francisco, where he graduated from Lowell High School. In 1951, he enrolled at the University of California, Berkeley. At Berkeley, he played for the school's water polo team and majored in economics, graduating in 1955. In 1959, he graduated with an M.B.A. from Harvard Business School.[6]

Career

After school, he worked in investment banking at Lehman Brothers becoming a partner at age 28, the youngest in the firm's history.[9][7] In 1973, he was named president and head of investment banking[7] and also head of the Investment Banking Division and Chairman of Lehman Corporation. In 1977, he moved to Boston and co-founded with Paul J. Ferri a venture capital firm, Hellman, Ferri Investment Associates (later renamed Matrix Partners), an early-stage investor in SanDisk and Apple.[6] In 1984, he moved back to San Francisco and co-founded the buyout firm, Hellman & Friedman with Tully Friedman where he served as chairman of the firm as well as a member of the Firm's Investment and Compensation Committees.

Hellman & Friedman's strategy was to buy companies heavy on intellectual capital (typically financial services or software companies) and light on physical assets (such as manufacturers) with strong cash flows that needed operational improvements.[6] In 1995, the firm purchased Levi Strauss & Co. from 250 family shareholders and consolidated it among four men including Hellman and then-CEO Robert D. Haas.[6] The company reduced its debt and improved its earnings.

Family history and philanthropy

Though his fortune was largely self-made, Hellman was the great-grandson of Isaias W. Hellman, a prominent early California banker (President of Wells Fargo Bank), philanthropist, and a founding father of the University of Southern California.[10] Isaias Hellman's sister-in-law was married to Mayer Lehman, one of the founders of Lehman Brothers. Warren Hellman's mother, the former Ruth Koshland, was the granddaughter of Jesse Koshland, and great grand-daughter of Simon Koshland, pioneer wool merchants in San Francisco (a nephew of Jesse Koshland, Daniel E. Koshland Sr., served as the CEO of Levi Strauss & Co).

Hellman was married to Patricia Christina "Chris" Sander;[5] they had four children: Frances Hellman, Patricia Hellman Gibbs, Marco "Mick" Hellman, and Judith Hellman. His funeral was held at Congregation Emanu-El in San Francisco.[11]

Berkeley

The Hellman family's association with Berkeley dates back to 1888, when Hellman's grandfather, Isaias W. Hellman Jr., matriculated at Berkeley, graduating as a member of the university's twentieth class. His father, an investment banker, graduated from Berkeley in 1927 and from Harvard Business School in 1929. His grandaunts, Clara Hellman Heller and Florence Hellman Ehrman, endowed various Berkeley professorships and research committees; their husbands, Emanuel S. Heller and Sidney M. Ehrman, founders of the international law firm Heller Ehrman, were also Berkeley alumni. Berkeley's Hellman Tennis Complex is named in honor of his uncle, Isaias W. Hellman III, Class of 1920. Isaias Hellman was president of Wells Fargo and an active benefactor of the university, funding projects ranging from the Bancroft Library to the Alumni House and the former Barrows Hall.

Warren and Chris Hellman were also major Berkeley donors, contributing some $50 million either directly or through their charitable foundation. Among their many contributions are a $5 million gift in 1994 to support junior faculty research, a major joint gift in 2005 to support Cal's aquatics teams, and a $20 million endowment gift in 2018 to fund Berkeley's Hellman Fellows Program in perpetuity. From its inception in 1995 until its permanent endowment in 2018, Berkeley's Hellman Fellows Program supported 384 early-stage faculty members with awards of up to $50,000 for each fellow. Their foundation also supported various athletic programs, the Biology Scholars Program, the Lawrence Hall of Science, the Magnes Collection, the Blum Center, the Haas School of Business, and a host of undergraduate, graduate, and faculty initiatives.

Hellman's daughter, Frances Hellman, who holds a Ph.D. from Stanford, is professor of physics and Dean Emeritus of the Division of Mathematical and Physical Sciences at Berkeley. His daughter, Patricia Hellman Gibbs, M.D., the 2006 recipient of Berkeley's Public Health Heroes Award and a graduate of Williams and Yale School of Medicine, is the co-founder of the San Francisco Free Clinic. Hellman's son, Mick, an investment manager, like his father and grandfather, graduated from Berkeley, where he studied economics (Class of 1983), and from Harvard Business School. His daughter, Judith Hellman, M.D., who studied microbiology at Berkeley (Class of 1984) and medicine at Columbia, is the William L. Young Endowed Professor and Vice Chair for Research at the University of California, San Francisco. Five generations of the Hellman family have attended Berkeley.[12]

Other affiliations

Hellman served in the U.S. Army from 1955 through 1957.[13]

An avid skier, Hellman co-founded Stratton Mountain School in 1972. As a supporter of the then U.S. Ski Educational Foundation, Hellman served both as a trustee and president of the U.S. Ski Team from the late ’70s to mid-’80s. Hellman won the national championship in Ride and Tie racing (in his age category) five times and competed in the western States Endurance Run, a 100 mile ultramarathon.[14]

Hellman was the Chair of the Board of Trustees for Mills College from 1982–1992, and as a result of protests reversed the college's decision to go co-ed in 1990.[15]

Hellman was a Director of D.N.& E. Walter & Co. and Sugar Bowl Corporation. He was also a member of the advisory board of the Haas School of Business at Berkeley. In 1997, he was inducted into the American Academy of Achievement.[16][17] In 2005, Hellman was inducted into the American Academy of Arts and Sciences.

Hellman and latterly the Hellman Trust Foundation is the primary sponsor and provided funding for the Hardly Strictly Bluegrass music festival in San Francisco's Golden Gate Park.[18][19][20] In 2011, Speedway Meadow was renamed Hellman Hollow to honor his history of philanthropy and civic involvement in San Francisco.[21]

Hellman was a donor and supporter of Jewish Vocational Services (JVS), a nonprofit organization that helps people transform their lives through work.

Hellman was the Chairman of the Board of The Bay Citizen, a non-profit news organization focusing on the San Francisco Bay Area. The Bay Citizen was founded with a $5 million contribution from the Hellman Family Foundation.[22]

He formerly served as a Director of numerous portfolio companies, including Eller Media Company, Nasdaq Stock Market and Young & Rubicam.

References

- Hellman & Friedman Raises $8.8 Billion Buyout Fund. Bloomberg, October 1, 2009

- Benjy Eisen (February 20, 2012). "Hardly Strickly Bluegrass Stars Celebrate Life of Billionaire Philanthropist Warren Hellman". rollingstone.com.

- "The Billionaire Who Loved Bluegrass - the Bay Citizen". Archived from the original on November 7, 2012. Retrieved August 19, 2013.. Bay Citizen, December 18, 2011

- Contemporary Jewish Museum: "Hardly Strictly Warren Hellman – Sep 18, 2014–Ongoing retrieved March 29, 2015

- Jewish Weekly: "Warren Hellman: S.F., Jewish community lose an icon" by Dan Pine December 22, 2011

- Baker, David R. (December 19, 2011). "Warren Hellman, financier and philanthropist, dies at 77 – Warren Hellman 1934–2011 'Renaissance man' was force in local politics, culture". San Francisco Chronicle.

- Bay Citizen: "The Billionaire Who Loved Bluegrass – Financier and philanthropist spread around his millions so "good things will grow" by Jane Ganahl December 18, 2011

- Hellman & Friedman: "F. Warren Hellman, Beloved Founder, Passes Away at 77" December 18, 2011

- "A Casual Approach to Success – Alumni – Harvard Business School". www.alumni.hbs.edu. March 2003. Retrieved July 12, 2018.

- Amster, Joseph. "Finding fulfillment :Warren Hellman joins his daughter for a special double b'nai mitzvah". Jweekly.com. Retrieved August 27, 2009.,

- Fog City Journal: "A Fitting Tribute to Warren Hellman, “The Prince of Humanity” by Kat Anderson December 22, 2011

-

- "Endowed Chairs of Learning: Berkeley", The Centennial of the University of California, 1868-1968, University of California

- "Hellman Tennis Complex". calbears.com.

- https://snaccooperative.org/ark:/99166/w63v6dd0

- "Record $20 million matching gift will fund early-career faculty fellowships in perpetuity". Berkeley News. October 24, 2018.

- https://www.irs.gov/charities-non-profits/tax-exempt-organization-search

- https://www.hellmanfellows.org/

- José Rodriguez (August 30, 1995). "An Extraordinary Year: $156 Million in Private Gifts". Berkeley News.

- Chris Avery (August 30, 2005). "$12.5 Million Lead Gift to Cal Aquatics". 247sports.com.

- https://www.ucberkeleyfoundation.org/wp-content/uploads/PDFH13774PHILRep2019UCBFFINAL12519highresoptimized.pdf

- Debora Silva (March 15, 2014). "Gift to UC Berkeley Establishes the Hellman Graduate Awards Program". Berkeley Graduate Division News.

- "HMI Capital's Returns, AUM and Holdings". December 7, 2018. Retrieved June 1, 2019.

- https://www.amacad.org/person/frances-hellman

- "Frances Hellman to head L&S Division of Mathematical and Physical Sciences". November 30, 2001. Retrieved June 11, 2014.

- Jeanine P. Wiener-Kronish, MD (October 2019). "Judith Hellman, M.D., Recipient of the 2019 Excellence in Research Award". American Society of Anesthesiologists.

- "Marin Women's Hall of Fame Honorees: Patricia Gibbs". yourywca.org.

- "A Review Of The Fabulous Life Of Private Equity Investor Warren Hellman". Business Insider. December 19, 2011.

- Peter Lattman (December 19, 2011). "Warren Hellman, 77, Investor Who Loved Bluegrass, Dies". The New York Times.

- Gordon, Larry (May 19, 1990). "Mills College Scraps Plan to Admit Men". Los Angeles Times.

- "Golden Plate Awardees of the American Academy of Achievement". www.achievement.org. American Academy of Achievement.

- "2004 Summit Photo". 2004.

Awards Council member, financier, and philanthropist Warren Hellman introduces 2004 honoree musician and philanthropist Emmylou Harris to Academy delegates and members at the Art Institute of Chicago's Trading Room.

- Warren Hellman strums those recession blues. San Francisco Business Times, February 22, 2008

- Warren Hellman: A tough banjo to pluck. San Francisco Examiner, September 20, 2008

- Made Money, Makes Music. Forbes, October 5, 2006

- Gordon, Rachel. "Warren Hellman honored with Golden Gate Park meadow renaming | City Insider | an SFGate.com blog". Blog.sfgate.com. Retrieved December 19, 2011.

- "The Bay Citizen". The Bay Citizen. Retrieved December 19, 2011.

External links

- F. Warren Hellman – Profile (Hellman & Friedman company website)

- Fixing the greed in private equity. Fortune, October 16, 2007