AngelList

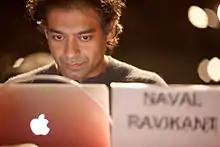

AngelList is a U.S. website for fundraising and connecting startups, angel investors, and limited partners.[1][2] Founded in 2010, it started as an online introduction board for tech startups that needed seed funding.[3] Since 2015, the site allows startups to raise money from angel investors free of charge.[3][4] Created by serial entrepreneur Naval Ravikant and Babak Nivi in 2010, Avlok Kohli has been leading AngelList as its CEO since 2019.[5]

AngelList's logo | |

Type of site | Entrepreneurship, Startups, Investments, Recruitment |

|---|---|

| Available in | English |

| No. of locations | 3 |

| Owner | Venture Hacks, Inc. |

| Founder(s) | Naval Ravikant and Babak Nivi |

| CEO | Avlok Kohli |

| Subsidiaries | Product Hunt, Republic, CoinList, Wellfound |

| URL | angellist |

| Commercial | Yes |

| Launched | April 22, 2010 in San Francisco, CA |

History

AngelList was founded in 2010 by serial entrepreneur Naval Ravikant and Babak Nivi. Using the traction from the Venture Hack blog on entrepreneur financing, Naval and Babak started a list of 25 investors with whom they would share interesting companies to invest in.[1] They announced the list as "AngelList" in 2010, with the subscription of 50 angel investors who intended to invest USD $80 million that year.[6][7]

Mission and operations

Business Insider dubbed AngelList the "Match.com for investors and startups".[8] In a recent interview, Naval Ravikant wants more "innovation on [the] infrastructure for innovation itself" by helping startups with money, talent, and customers.[9]

AngelList's Syndicate facilitates startup financing with accredited investors. AngelList Jobs connect talents with startups, with over 35,000 recruiting companies, more than 2,000,000 candidates and 5 million registered users.[10][11] AngelList's acquisition of Product Hunt will allow more support for startups with customer generation and product launch.[12][13][10] AngelList Syndicates allow startups to raise money from accredited investors investing alongside prominent angel investors.[14][15][16][17]

History

AngelList launched Jobs – its recruiting portal – in 2012.[18][19]

In late 2012, AngelList launched a portal for accelerators and incubators to accept and manage applications from startups to their programs.[20] At opening, AngelList accepted applications for 500 Startups, TechStars Boston, and AngelPad. Other accelerators, like Rock Health, accept applications exclusively through AngelList.[1][21][22]

In 2013, AngelList received a no-action letter from the SEC, allowing the operations of its Syndicates platform. FundersClub also received such a letter in the same period.[23][24] AngelList Syndicates was noted as one of the most important innovations in the venture capital and angel investment industries, getting momentum with several well-known figures in the tech community creating syndicates, including Jason Calacanis, Scott Banister, Tim Ferriss, Gil Penchina, Scott and Cyan Banister, Fabrice Grinda, Elad Gil and more.[25][26] In 2017, AngelList had 4,400 investors operating across 165 syndicates.

In March 2014, AngelList launched Maiden Lane, a first online venture fund for investing in syndicated deals.[25] It was launched with more than $25 million in funding from a variety of investors.[27][28][29] In 2014, women represented only 7.4% of all AngelList investors.[30]

In October 2015, AngelList announced a deal with a Chinese third-largest private equity firm CSC (China Science & Merchants Investment Management Group) for establishing a new $400 million fund for early-stage startup investments.[31][32] According to The Wall Street Journal, the deal became the "largest single pool of funds devoted to early-stage startups — ever," and also the "largest-ever single investment by a Chinese private-equity firm in a U.S. fund."[31][32]

Prior to the deal, the Wall Street Journal said AngelList "had raised $205 million from all sources, including $43 million from institutional investors."[32]

In July 2016, AngelList launched Republic - a spinoff addressing the democratization of startup equity crowdfunding with non-accredited investors.[33][9]

In November 2016, AngelList acquired Product Hunt for $20 million.[12][13][10] Naval Ravikant planned to use Product Hunt to further "[help] companies find their early customers."[9]

In October 2017, CoinList – initial coin offering services for startups and accredited investors – spun off from AngelList.[34] At the end of 2017 AngelList had profiles of over 70,000 startups.[35]

In early 2018, AngelList expanded its Syndicates program to India.[36]

In 2020, AngelList launched rolling funds, an investment vehicle that raises money through a quarterly subscription from interested investors.[37] In the same year, AngelList India's CEO, Utsav Somani, launched a $5 million micro-fund, iSeed SEA, to invest in startups located in Southeast Asia.[38][39]

In 2021, AngelList raised $25 million for the AngelList Early Stage Quant Fund, an investment vehicle which plans to invest $250,000 in over 100 companies.[40]

In March 2022, AngelList closed its $100 million Series B led by Tiger Global. One month later, the company raised another bridge round of $44 million.[41]

In November 2022, AngelList Talent was spun out as a separate company and rebranded as Wellfound.[42][43]

In June 2023, AngelList announced its acquisition of Nova, an investor management software for institutional private funds. The purchase supported CEO Avlok Kohli's initiative to expand AngelList's customer base to include private equity.[44]

Involvement in the JOBS Act

In mid-2012, Naval Ravikant and Kevin Laws, AngelList's chief operating officer,[45] were active in Washington in his support for the Jumpstart Our Business Startups Act (JOBS Act), a law that eased many of the United States' securities regulations with the aim of making it easier for companies to either go public or to remain private longer while continuing to raise capital.[46][6][47] He was in discussion with "Senate and Congressional staffers, Steve Case, and influential Congressmen who would listen."[48] During the same period, he organized an online petition that attracted 5,000 signatures on a letter to Senate leaders in support of the Act.[6][49] Later in 2013, Naval Ravikant wrote a letter to the SEC to object to changes in the JOBS Act that he believed "could create disastrous unintended consequences for the startup community."[50]

References

- Davidson, Andrew (May 17, 2013). "Follow the money: AngelList has blown open early-stage investments". WIRED. Retrieved May 3, 2018.

- Stone, Brad (January 17, 2014). "AngelList, the Social Network for Startups". Bloomberg.com. Retrieved May 3, 2018.

- Primack, Dan (November 13, 2014). "A disruptor shakes up angel investing". Fortune. Retrieved May 3, 2018.

- Hardy, Quentin (March 31, 2015). "Angel Investors Lend Expertise as Well as Cash". The New York Times. ISSN 0362-4331. Retrieved May 3, 2018.

- "AngelList CEO Avlok Kohli on the Transforming the Company — and Venture Itself | Acquired Podcast". www.acquired.fm. Retrieved September 7, 2023.

- Halperin, Alex (March 24, 2014). "Silicon Valley's Avenging Angel". Fast Company. Retrieved May 3, 2018.

- Carter, Stinson (October 25, 2016). "A Day in the Life of Naval Ravikant". Wall Street Journal. ISSN 0099-9660. Retrieved May 4, 2018.

- Gobry, Pascal-Emmanuel (November 2, 2011). "The Way Companies Are Getting Financed Is Completely Changing". Business Insider. Retrieved May 3, 2018.

- Loizos, Connie (May 19, 2017). "Naval Ravikant hints at future plans for Product Hunt and adding secondary trading to AngelList – TechCrunch". TechCrunch. Retrieved May 4, 2018.

- Konrad, Alex (December 1, 2016). "AngelList Acquires Popular Tech Discovery Site Product Hunt To Go After Startup Jobs Search". Forbes. Retrieved May 4, 2018.

- "angel.co/build-your-team". AngelList. Retrieved November 7, 2019.

- Geron, Tomio (December 19, 2016). "Angels Muscling In on VC Turf". Wall Street Journal. ISSN 0099-9660. Retrieved May 4, 2018.

- Wagner, Kurt (December 1, 2016). "AngelList has acquired Product Hunt for around $20 million". Recode. Retrieved May 4, 2018.

- Eldon, Eric (July 28, 2013). "Angels Get Carry For Helping A Startup Raise Money With AngelList Syndicates – TechCrunch". TechCrunch. Retrieved May 3, 2018.

- Carlson, Nicholas (September 30, 2013). "The Startup Investing World Got Turned On Its Head Over The Weekend, And VCs Are Freaking Out". Business Insider. Retrieved May 3, 2018.

- Willis, Tyler (June 29, 2014). "An angel investor's ultimate guide to AngelList Syndicates". VentureBeat. Retrieved May 3, 2018.

- Baehr, Evan (January 23, 2016). "Profit From A Profile On AngelList – TechCrunch". TechCrunch. Retrieved May 4, 2018.

- Sloan, Paul (September 5, 2012). "AngelList attacks another startup pain point: Legal fees". CNET. Retrieved May 5, 2018.

- Terdiman, Daniel (August 16, 2012). "AngelList launches talent recruiting portal". CNET. Retrieved May 5, 2018.

- Griffith, Erin (November 16, 2012). "AngelList now powering applications for incubators like TechStars Boston, AngelPad". Pando. Retrieved May 5, 2018.

- Rao, Leena (February 26, 2013). "Startup Accelerator Rock Health Now Accepts Applications Exclusively Through AngelList – TechCrunch". TechCrunch. Retrieved May 5, 2018.

- Hoque, Faisal (January 15, 2016). "Do Accelerators And Incubators Serve Themselves Better Than Startups?". Fast Company. Retrieved May 5, 2018.

- Lawler, Ryan (March 31, 2013). "As Crowdfunding Takes Off, SEC Greenlights AngelList's Investment Platform – TechCrunch". TechCrunch. Retrieved May 3, 2018.

- Doyle, Dentons-Rani (April 19, 2013). "FundersClub: what does the SEC's no-action relief really mean? | Lexology". Lexology. Retrieved May 3, 2018.

- "Moneyball for AngelList Syndicates". CB Insights Research. April 22, 2014. Retrieved March 15, 2019.

- "Ranking the Top Angel and Venture Capital Fund Managers (Part 1)". Financial Poise. August 12, 2016. Retrieved March 15, 2019.

- "Here's Proof That Crowdfunding Pays Off". Fortune. Retrieved March 15, 2019.

- "AngelList Unveils Maiden Lane, A $25 Million Fund For AngelList Deals". TechCrunch. Retrieved March 15, 2019.

- "Angel List shakes up startup funding again with a new $25 million fund". SmartCompany. April 15, 2014. Retrieved March 17, 2019.

- "Gender Gap in Start-Ups and Women's Access to Financing". GenderGapGrader. October 21, 2014. Retrieved February 8, 2021.

- "AngelList gets $400M from China's CSC Venture Capital for early-stage startup investments". VentureBeat. October 12, 2015. Retrieved March 16, 2019.

- Mims, Christopher (October 12, 2015). "Coming Soon From China: A $400 Million Bonanza for U.S. Startups". Wall Street Journal. ISSN 0099-9660. Retrieved March 16, 2019.

- Dodson, Claire; Richardson, Nikita (August 8, 2016). "Updates From Our Most Innovative Companies". Fast Company. Retrieved May 4, 2018.

- Kokalitcheva, Kia (October 10, 2017). "CoinList spins out of AngelList". Axios. Retrieved May 4, 2018.

- Kauflin, Jeff. "12 Websites To Jump-Start Your Career In 2018". Forbes. Retrieved March 15, 2019.

- "AngelList launches Syndicates in India". TechCrunch. Retrieved January 6, 2022.

- "AngelList pioneers rolling VC funds in pivot to SaaS". TechCrunch. Retrieved November 22, 2020.

- Gooptu, Biswarup. "iSeed opens South East Asia fund". The Economic Times. Retrieved November 22, 2020.

- "A new micro-fund, iSeed SEA is investing $100k into SEA startups". BEAMSTART - Business Community, Resources, & Opportunities. Retrieved November 22, 2020.

- Natasha, Mascarenhas. "AngelList just closed a $25M fund to back startups based on hiring velocity". TechCrunch. TechCrunch. Retrieved December 26, 2021.

- Matthews, Jessica (April 22, 2022). "Exclusive: AngelList raises $44 million from 10% of its customers". Fortune. Fortune. Retrieved May 11, 2022.

AngelList Venture opened up a follow-on round to its most active GPs and LPs and raised an additional $44 million.

- "AngelList Spins Out Jobs Community, Rebrands As Wellfound | Crowdfund Insider". www.crowdfundinsider.com. November 16, 2022. Retrieved December 29, 2022.

- Matani, Amit (November 15, 2022). "AngelList Talent is now Wellfound". AngelList Talent. Retrieved December 29, 2022.

- Azevedo, Mary Ann (July 28, 2023). "AngelList expands into private equity with acquisition of fintech startup Nova". TechCrunch. Retrieved September 7, 2023.

- "AngelList Unveils Maiden Lane, A $25 Million Fund For AngelList Deals". TechCrunch. Retrieved March 15, 2019.

- Timoner, Ondi (October 7, 2013). "How Naval Ravikant Risked It All To Pull The Veil Back on Venture Capital". Huffington Post. Retrieved May 3, 2018.

- Coren, Michael J. (May 16, 2017). "AngelList is funding the minor leagues of venture capital (and giving founders $500,000 to start)". Quartz. Retrieved May 4, 2018.

- Khazan, Olga (March 27, 2012). "With passage of JOBS Act, Steve Case, AngelList founder and others look forward to a less-regulated start-up world". Washington Post. ISSN 0190-8286. Retrieved May 3, 2018.

- Khazan, Olga (April 1, 2012). "JOBS Act aims to simplify start-up fundraising". Washington Post. ISSN 0190-8286. Retrieved May 3, 2018.

- Constine, Josh (August 17, 2013). "AngelList Tells SEC New Fundraising Rules Will Kill Startups – TechCrunch". TechCrunch. Retrieved May 3, 2018.