Alliance for Financial Inclusion

The Alliance for Financial Inclusion (AFI) is a policy leadership alliance owned and led by member central banks and financial regulatory in developing countries with the objective of advancing financial inclusion.[1]

AFI's HQ at Sasana Kijang, Kuala Lumpur | |

| Abbreviation | AFI |

|---|---|

| Formation | January 1, 2008 |

| Founders | Bangko Sentral ng Pilipinas, Bank Indonesia, Bank Indonesia, Bank of Thailand, Central Bank of Kenya, Comisión Nacional Bancaria y de Valores |

| Type | An independent international organization constituted under the International Organizations (Privileges and Immunities) Act 1992 of the Laws of Malaysia since January 2016.

Policy leadership alliance Peer-learning network Capacity building |

| Purpose | Financial inclusion, Poverty reduction, Inclusive Green Finance, gender inclusive finance. |

| Headquarters | Kuala Lumpur, |

| Location |

|

Region served | Worldwide |

Official language | English |

Executive Director | Dr. Alfred Hannig |

Staff | 50-100 |

| Website | www |

Its members include roughly 100 institutions, being central banks, financial regulatory institutions, and financial inclusion policymakers from nearly 90 developing and emerging economies.[2] AFI partners with regulators in advanced economies, international organizations and private sector leaders to drive practical solutions and facilitate the implementation of impactful policy changes through its cooperative model that embeds peer learning, knowledge exchange and peer transformation.

AFI was founded on the idea that a global knowledge exchange platform was key to expanding and improving financial inclusion policies. AFI connects, encourages and enables policymakers to build capacity and develop policy initiatives in areas of financial technology (fintech), consumer protection, microfinance, SME finance, gender inclusive finance, inclusive green finance and other general financial inclusion initiatives in Africa, Asia, Caribbean, Eastern Europe and Caucasus, Latin America, Middle East and Pacific Islands. Each year, AFI holds its flagship event, Global Policy Forum (GPF), the world's largest financial inclusion gathering of policymakers.

AFI is headquartered in Kuala Lumpur, Malaysia, with regional offices in Africa and Latin America, and a representation office in Europe.[3]

History

Origins and until 2008

In 2006, there was an emerging recognition that policies mattered when it came to financial inclusion. There is also a huge sentiment around the potential of digital financial services for increasing financial inclusion for the unbanked population of the world.

Dr. Hannig described the situation in 2006 as follows:[4]

"There was a lot of international debate on financial system development and what the financial sector can do to alleviate poverty through microfinance. ... We were just starting to see the potential of digital financial services for increasing financial inclusion for the unbanked."

Through the Gates Foundation, Dr. Alfred Hannig and the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) team successfully received grants to kick-off the first phase of AFI in Bangkok, Thailand and subsequently launched it in Kenya in 2009.

2009 to 2010

Less than two years after its launch, AFI went from an initial founding core group of five member institutions to members in more than 60 countries, representing nearly 70 percent of the world’s unbanked population.

In 2009, the network saw the first AFI Global Policy Forum, which was held in Nairobi, Kenya under the theme, A marketplace of ideas. Grants to selected member institutions were introduced.

In 2010, the Group of 20 (G20) nominated AFI as one of three implementing partners for the G20 Global Partnership for Financial Inclusion (GPFI). In this role, AFI brought policies for increasing access to financial services from developing countries to the wider G20 forum and facilitated the participation of non-G20 policymakers in developing and emerging economies participate in GPFI work.[5]

2011 Maya Declaration

At the 2011 GPF in Mexico’s Riviera Maya, AFI members collectively adopted the Maya Declaration, a global initiative for responsible and sustainable financial inclusion that aims to reduce poverty and ensure financial stability for the benefit of all. It is a statement of common principles regarding the development of financial inclusion policy.

More than 30 countries represented by AFI member institutions, went a step further by announcing specific and measurable commitments. As of October 2021, AFI member institutions have made a total of 885 Maya Declarations targets.

The Maya Declaration has paved the way for various other accords. In recognition of these developments, both the G20 and the Group of 24 (G24) highlighted the AFI learning model and the Maya Declaration as key steps toward global economic development, with the G20 urging its members to commit to the Maya Declaration.[6]

2013 to 2018

In 2013, AFI members adopted the Sasana Accord on Evidence- and Data-based Results, Accelerated Progress and Measurement of Impact.[7] During the same year, AFI reached 100 member institutions overall with the addition of the Central Bank of Trinidad and Tobago[8]

In 2015, AFI members endorsed the Maputo Accord, which commits members to support access to finance for small and medium enterprises. It also established its headquarters in Kuala Lumpur, Malaysia, which are hosted by Bank Negara Malaysia.

In 2016, AFI completed the final steps in its evolution from an exclusively donor-funded project into an independent and member-supported international network of policymakers. Members also endorsed the Denarau Action Plan for Gender Inclusive Finance[9] to increase women's access to quality and affordable financial services globally — bridging the financial inclusion gender gap.

In 2017, AFI members adopted the Sharm El Sheikh Accord on Financial Inclusion, Climate Change and Green Finance.[10]

In 2018, AFI set up its Africa Regional Office in Abidjan, Côte d'Ivoire, co-hosted by the country’s Ministres de l'Économie et des Finances and Banque Centrale des États de l'Afrique de l'Ouest (BCEAO). That same year, AFI also celebrated its 10th anniversary at its GPF in Sochi, Russia. During the event, members endorsed the Sochi Accord on FinTech for Financial Inclusion.[11]

In 2019, a letter of understanding was signed between AFI and the Ministry of Finance of the Grand Duchy of Luxembourg to launch a new multi-donor collaboration framework to bolster financial inclusion across the African continent.[12] Minister Pierre Gramegna signed the multilateral letter of undertaking, together with AFI Executive Director Dr. Hannig. The cooperation is rooted in the support toward the advancement of the Sustainable Development Goals.

2019 onwards: COVID-19 pandemic and AFI's response

The COVID-19 pandemic triggered widespread unemployment and falling levels of gross domestic product and disproportionately impacting the most disadvantaged segments of populations. This led to the implementation of AFI’s COVID-19 Policy Response, which aimed to systematically deliver coordinated policy responses to help AFI members mitigate the impact of COVID-19 on financial inclusion policy implementation, especially for micro, small and medium enterprises (MSMEs), women, youth, forcibly displaced and other vulnerable segments of the population.

Virtual engagements were conducted during the lockdown period with technical teams and leadership across its member countries to address specific issues. A series of member needs surveys were distributed to enable AFI to deploy rapid policy response guidelines.

AFI partnered with the Mastercard Foundation to implement a two-year COVID-19 Policy Response program in Africa. The program targeted 49 financial sector regulators and policymaking institutions across the region to effectively respond to the economic consequences of the pandemic. In-country implementation activities were conducted specifically in Nigeria, Uganda, Rwanda, Senegal, Ghana and the BCEAO member jurisdictions.

Responding to global trends, Dr. Hannig described in 2021 a recent evolution in financial inclusion:

“Financial inclusion is no longer just about access to finance and bringing unreached groups into access to formal financial services. [It] is becoming more about maintaining high levels of safe and sound financial access, with increasing usage and quality of financial services … embracing important issues such as financial health and financial resilience, with the ultimate objective to ensure financial stability”[13] – Dr. Alfred Hannig, AFI Executive Director

Impact

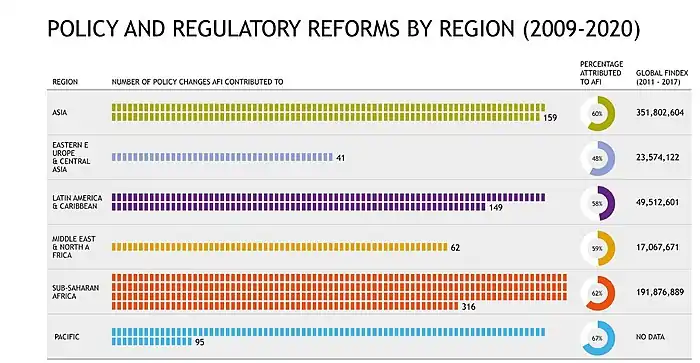

Since 2009, AFI members have developed and implemented over 820 policy changes to enhance financial inclusion. The level of attribution accorded to AFI for policy and regulatory reforms by members is 60 percent. This resulted in over 634 million people being brought to formal financial system as a result of AFI activities.

Since 2016, members have attributed over 100 policies and regulations to AFI annually, an indication that the preparatory work going back many years is beginning to be realized.

Organization

AFI's core mission is to empower policymakers to increase the access and usage of quality financial services for the underserved through the formulation, implementation and global advocacy of sustainable and inclusive policies.

AFI is the only existing member-based organization with a strong network of central banks and other financial regulatory institutions, that have a specific focus or sole mandate on financial inclusion to support empowerment of the poor and aid the attainment of Sustainable Development Goals (SDGs) through smart policies and regulations.

It was founded in 2009 by Bangko Sentral ng Pilipinas, Bank Indonesia, Bank of Thailand, Central Bank of Kenya and Comisión Nacional Bancaria y de Valores in close collaboration and with support from the Bill & Melinda Gates Foundation and the Deutsche Gesellschaft für Internationale Zusammenarbeit GmbH (GIZ), AFI was established with the goal of advancing the development of financial inclusion policy in developing and emerging economies.

In 2016, AFI became an independent, member-owned and member-based globally operating international organization under Malaysian law.

AFI uses a peer-to-peer learning model to connect, encourage and enable financial policymakers to interact and exchange knowledge on policy initiatives. AFI has pioneered knowledge exchange platforms among policymakers and stakeholders worldwide to build a more comprehensive knowledge base of financial inclusion. This has led to the formulation and implementation of effective policies by members institutions within their home jurisdictions.[14]

AFI also operates the AFI Data Portal (ADP), a unique and integrated global database on financial inclusion policies, regulations and outcomes. Housing information sourced directly from policymakers and regulators, the ADP empowers countries to share their financial inclusion stories and formulate policies through on data while also facilitating the study and understanding of trends in financial inclusion. The portal is accessible online and publicly available.

AFI administers financial inclusion policy-related services, including capacity building, developing-developed country dialogue, grants, in-country implementation support, knowledge products, regional initiatives and working groups, global advocacy on financial inclusion

Since the first AFI GPF in 2009, the event has supported an environment of historic financial inclusion policy initiatives and declarations, including the Maya Declaration, the first global and measurable set of financial inclusion commitments by developing and emerging economies.

AFI Cooperation model

AFI’s cooperation model was designed to fulfil the objectives of supporting members’ financial inclusion agenda. Putting members in the driving seat of agenda setting for financial inclusion policy, AFI’s unique cooperation model is based on the following principles:

- Effective governance with Board of Directors and management unit driven by values of transparency, accountability and flexibility

- Apolitical and non-bureaucratic

- Full ownership by members who lead and set the agenda for the network’s initiatives including Working Groups, Regional Initiatives and capacity building

- Equality, inclusiveness and equity

- Solid administrative and financial system with resources focused on operational and financial sustainability

- Meaningful and binding partnerships with like-minded institutions

- Permanence and agility

- Sustainability of AFI services and knowledge resources [15]

Working groups

AFI has seven working groups. They serve as the technical backbone for generating knowledge, guiding and implementing policies, and developing policies. The working groups produce policy guidelines and tools for formulating financial inclusion policies, provide peer reviews, and contribute to the engagement of global standard-setting bodies (SSBs). They also all work on gender inclusive finance as a cross thematic area and have gender focal points.

Since the first meeting was held in 2010, working groups have grown rapidly in size and number. As of March 2022, 76 member institutions from 65 developing and emerging countries participate in working groups. They represent the leaders of financial inclusion policy and, together, have passed over 520 policy changes in their respective jurisdictions.[16]

They also represent the thematic areas that AFI actively participates in:

- Consumer Empowerment and Market Conduct (CEMC)[17]

Examines the importance of consumer empowerment and protection to improve the quality of financial services. CEMC Working Group also advances policy and regulatory issues related to consumer empowerment initiatives and market conduct regulations.

- Digital Financial Services (DFS)[18]

Discusses issues related to digital financial services and promotes digital finance as a major catalyst in achieving financial inclusion in emerging and developing economies. The working group also develops policy guidelines, conducts peer reviews and engages the fintech industry and global SSBs.

- Financial Inclusion Data (FID)[19]

Builds knowledge and good practices on areas related to financial inclusion measurements, such as indicators, methodologies, global standards and principles.

- Financial Inclusion Strategy (FIS)[20]

Promotes the development, implementation, and monitory and evaluation of national financial inclusion strategies.

- Global Standards Proportionality (GSP)[21]

Provides technical support on the proportionate application of global standards while supporting, exchanging and discussing measures that strengthen and balance both financial sector stability and integrity.

- Inclusive Green Finance (IGF)[22]

Discusses and creates financial policies that build resilience to mitigate and adapt to the effects of climate change, and to facilitate a just transition towards a low carbon economy.

- SME Finance (SMEF)[23]

Promotes the discussion and implementation of smart policies that facilitate the access of MSMEs to finance and provides a platform for members to discuss related challenges and opportunities.

In addition, AFI working groups cover current and emerging global trends that have the potential for widespread impact. Member institutions have significant interest in developing policies that mitigate the challenges posed by the following policy areas:

- Forcibly displaced persons

- Gender inclusive finance

- Inclusive fintech

- Youth financial inclusion

Regional Initiatives

Regional initiatives bring AFI closer to its members and strengthen regional cooperation in financial inclusion. They also enhance the network’s ability to support its members working on specific regional priorities, sharing regional knowledge and translating global financial inclusion issues into practical implementation at the regional and national level. The network has five key regional initiatives:

African Financial Inclusion Policy Initiative (AfPI) [24]

AfPI is the primary platform for AFI members in Africa to support and develop financial inclusion policies and regulatory frameworks, and to coordinate regional peer learning efforts. From AFI’s regional office in Abidjan, Côte d'Ivoire, AfPI brings together high-level representatives from African financial policymaking and regulatory institutions to enhance the implementation of innovative financial inclusion policies across the continent.

Key AfPI initiatives include leaders’ roundtables, private-public dialogues, capacity building workshops, developed-developing country dialogues and meetings of its experts’ group on financial inclusion policy.

As of 2021, 39 AFI member institutions from 37 countries participate in AfPI. Together, they have implemented 251 policy changes that can be attributed to the regional initiative’s work in financial inclusion. They have also published 15 knowledge products and 331 Maya Declaration commitments.

Eastern Europe & Central Asia Policy Initiative (ECAPI) [25]

Launched at the 2018 AFI GPF in Sochi, Russia, ECAPI aims to resolve regional challenges and elevate the voice of Eastern European and Central Asian nations on key financial inclusion policy issues. Countries within the region require focused and tailored solutions to tackle its financial inclusion challenges, including low levels of financial literacy, high volume of remittances and underdeveloped consumer protection policies.

While the region has witnessed significant advancements in financial access in recent years, at least 121 million people remain excluded from formal banking. Through the activities implemented in ECAPI, members aim to:

- Increase access to financial services for the 50 percent unbanked youth.

- Address the regional six percent gender gap.

- Reduce the 25 percent gap in access between those with lower and higher levels of education.

- Focus on advancing financial inclusion for the poorest 40 percent of the population.

As of 2021, seven AFI member institutions in seven countries collaborate under ECAPI. They have implemented 29 policy changes linked to the regional initiative’s work in financial inclusion, published four knowledge products and made 53 Maya Declaration commitments.

Financial Inclusion for the Arab Region Initiative (FIARI) [26]

FIARI is a regional platform created amid growing demand from member institutions for tailored solutions to regional financial inclusion issues. Launched by the Arab Monetary Fund, GIZ and AFI in 2017, and later joined by the World Bank, it aims to enhance access to financial services in the Arab region through effective coordination mechanisms and supporting the implementation of national financial inclusion policies.

As of 2021, FIARI comprises 22 AMF member institutions, including eight AFI members. Within the AFI network, members’ contributions has led to the implementation of 34 policy changes and 74 Maya Declaration commitments in the Arab Region.

Financial Inclusion Initiative for Latin America and the Caribbean (FILAC) [27]

FILAC is a regional initiative that aims to be the driving force for advancing financial inclusion in Latin American and Caribbean countries. It was launched in 2016 with support from Canada’s International Development Research Center.

As of 2021, FIARI’s 12 AFI members in 11 countries have implemented 99 policy changes and published 13 knowledge products. They have made 174 Maya Declaration commitments.

Pacific Islands Regional Initiative (PIRI) [28]

Officially launched in Dili, Timor-Leste, in 2015, PIRI aims to make formal financial services accessible to all Pacific Islanders through its unique model of south-south engagement and peer learning. The region has one of the highest rates of unbanked persons globally due to factors including geographically dispersed islands, small populations and limited banking infrastructure.

The initiative invites AFI member institutions to share in a common vision while working toward ensuring that financial services are widely accessed throughout the region. With PIRI, AFI has created a unique model of south-south engagement and peer learning that aims to provide all low-income Pacific Islanders with access to formal and informal financial services.

As of 2021, the regional initiative comprised eight AFI members in eight countries. Their work has contributed to 65 policy changes and led to the publication of eight knowledge products. Members have made 66 Maya Declaration commitments.

AFI Global Policy Forum

The AFI Global Policy Forum (GPF) is organized annually by AFI and is the keystone event for its membership and financial inclusion policymakers globally.

The first GPF was co-hosted by the Central Bank of Kenya in September 2009 in Nairobi, Kenya, and attracted nearly 100 central bankers and other financial policymakers, providing a platform for policymakers in developing countries to engage in dialogue and share knowledge and experiences in expanding access to financial services.

In his opening remarks, Central Bank of Kenya Governor Prof. Njuguna Ndung'u summarized the goal of the GPF when he stated: "We will, over the next three days, share experiences on smart financial inclusion policies that have worked elsewhere. We will thereafter adopt these policies to suit our respective countries as we work together to push forward the global financial access frontiers."

Members

AFI's members consist of central banks, monetary authorities, and other financial institutions. AFI members are responsible for choosing the policies to focus on.[29]

| Country | Principal members | Associate members |

|---|---|---|

| Banco Nacional de Angola | ||

| Banco Central de la República Argentina | ||

| Central Bank of Armenia | ||

| Central Bank of The Bahamas | ||

| Bangladesh Bank |

| |

| National Bank of the Republic of Belarus | ||

| Royal Monetary Authority of Bhutan | ||

| Ministère de l’Economie et des Finances du Burkina Faso | ||

| Banque de la République du Burundi | ||

| National Bank of Cambodia | Securities and Exchange Commission of Cambodia | |

|

||

| Banca de las Opportunidades | ||

| Banque Centrale du Congo | ||

| PSuperintendencia General de Entidades Financieras de Costa Rica | ||

| Ministère de l’Économie et des Finances de la Côte d'Ivoire | ||

| Superintendencia de Bancos de la República Dominicana | ||

| Superintendencia de la Economía Popular y Solidaria de Ecuador | ||

| Central Bank of Egypt | ||

| Banco Central de Reserva de El Salvador | ||

| National Bank of Ethiopia | ||

| Ministry of Finance - Eswatini | Central Bank of Eswatini | |

| Reserve Bank of Fiji | ||

| Central Bank of The Gambia | ||

|

||

| Banque Centrale de la République de Guinée | ||

| Banque de la République d'Haiti | ||

| Comisión Nacional de Bancos y Seguros de Honduras | ||

| Central Bank of Iraq | ||

| Central Bank of Jordan | ||

| National Bank of Kazakhstan | ||

| Central Bank of Kenya |

| |

| National Bank of the Kyrgyz Republic | State Service of Regulation and Supervision for Financial Markets | |

| Central Bank of Lesotho | ||

| Central Bank of Liberia | ||

|

||

| Reserve Bank of Malawi | ||

| Bank Negara Malaysia | ||

| Maldives Monetary Authority | ||

| Banque Centrale de Mauritanie | ||

| Comisión Nacional Bancaria y de Valores | ||

| Financial Regulatory Commission of Mongolia | ||

| Bank Al-Maghrib | ||

| Banco de Moçambique | ||

| Bank of Namibia | ||

| Nepal Rastra Bank | ||

| Ministère des Finances de la République du Niger | ||

| Central Bank of Nigeria | Nigeria Deposit Insurance Corporation | |

| State Bank of Pakistan | ||

| Palestine Monetary Authority | ||

| Bank of Papua New Guinea | ||

| Banco Central del Paraguay | ||

| Superintendencia de Banca, Seguros y AFP del Perú | ||

| Bangko Sentral ng Pilipinas | ||

| Central Bank of the Russian Federation | ||

| National Bank of Rwanda | ||

| Central Bank of Samoa | ||

| Banco Central de São Tomé e Príncipe | ||

| Ministère de l'Economie, des Finances et du Budget du Sénégal | ||

| Central Bank of Seychelles | ||

| Bank of Sierra Leone | ||

| Central Bank of Solomon Islands | ||

| National Treasury of the Republic of South Africa | South African Reserve Bank | |

| Central Bank of Sri Lanka | ||

| Central Bank of Sudan | ||

| Centrale Bank van Suriname | ||

| National Bank of Tajikistan | ||

| Bank of Tanzania | Social Security Regulatory Authority of Tanzania | |

| NBank of Thailand | ||

| Banco Central de Timor-Leste | ||

| Ministère de l'Economie et des Finances du Togo | ||

| National Reserve Bank of Tonga | ||

| Central Bank of Trinidad and Tobago | ||

|

Autorité de Contrôle de la Microfinance de la République Tunisienne | |

| Bank of Uganda | Insurance Regulatory Authority of Uganda | |

| Central Bank of the Republic of Uzbekistan | ||

| Reserve Bank of Vanuatu | ||

| Central Bank of Yemen | ||

| Bank of Zambia, Ministry of Finance | ||

| Reserve Bank of Zimbabwe |

| Region | Principal member | Associate member | Observer member |

|---|---|---|---|

| Central African States (Republic of the Congo, Cameroun, Gabon, Equatorial Guinea, Central African Republic, Chad) | La Commission Bancaire de Afrique Centrale | ||

| West African States - Union Monétaire de l'Afrique de l'Ouest (Bénin, Burkina Faso, Côte d'Ivoire, Guinea Buisseau, Mali, Niger, Senegal, Togo) | Banque Centrale des Etats de l'Afrique de l'Ouest |

Donors and partners

In 2016, AFI completed its transition from being an exclusively donor-funded project into an independent and member-supported international network of policymakers. However, AFI still continued to form strategic collaborations with a variety of global donors and partners from both the public and private sectors. These include:[30][31]

- French Development Agency (AFD)

- German Federal Ministry of the Environment, Nature Conservation and Nuclear Safety (BMU)

- German Federal Ministry of Economic Cooperation and Development (BMZ)

- Swedish International Development Agency (Sida)

- UK Foreign, Commonwealth & Development Office

- Luxembourg's Ministry of Finance

- Luxembourg Ministry of Foreign and European Affairs

- Bill & Melinda Gates Foundation

- Flourish, part of the Omidyar Network

- Mastercard Foundation

References

- "Alliance for Financial Inclusion Official Website".

- "About Us". AFI Alliance for Financial Inclusion.

- "AFI - Alliance for Financial Inclusion".

- "AFI turns 10". Retrieved 2020-06-20.

- "Australian Government AusAid". Archived from the original on 2013-06-27. Retrieved 2013-03-27.

- "Maya Declaration | Alliance for Financial Inclusion".

- "Sasana Accord on Evidence- and Data-based Results, Accelerated Progress and Measurement of Impact" (PDF).

- The Trinidad and Tobago Guardian: Central Bank of T&T joins AFI

- "Denarau Action Plan for Gender Inclusive Finance".

- "Sharm El Sheikh Accord on Financial Inclusion, Climate Change and Green Finance" (PDF).

- "Sochi Accord on FinTech for Financial Inclusion" (PDF).

- "SLuxembourg signing will help bolster financial inclusion across the African continent".

- Hannig, Alfred (26 October 2021). "AFI Global Fintech Dialogue on Open Finance: Innovations and Inclusion – Opening remarks by AFI Executive Director Dr. Alfred Hannig". afi-global.org.

- "AFI - Alliance for Financial Inclusion".

- "AFI - Alliance for Financial Inclusion - About Us".

- "AFI working groups".

- "Consumer Empowerment and Market Conduct Working Group (CEMCWG)". www.afi-global.org.

- "Digital Financial Services Working Group (DFSWG)".

- "Financial Inclusion Data Working Group (FIDWG)".

- "Financial Inclusion Strategy Peer Learning Group(FISPLG)".

- "Global Standards Proportionality Working Group (GSPWG)".

- "Inclusive Green Finance Working Group (IGFWG)".

- "SME Finance Working Group (SMEFWG".

- "African Financial Inclusion Policy Initiative (AfPI)".

- "Eastern Europe & Central Asia Policy Initiative (ECAPI)".

- "Financial Inclusion for the Arab Region Initiative (FIARI)".

- "Financial Inclusion Initiative for Latin America and the Caribbean (FILAC)".

- "Pacific Islands Regional Initiative (PIRI)".

- AFI Member Map

- "Alliance for Financial Inclusion - Donors & Partners".

- "2018 AFI Annual Report" (PDF). Alliance for Financial Inclusion.